“The iPad is far more subtle, in fact it really is like a drawing pad. They will sell by the million. It will change the way we look at everything from reading newspapers to the drawing pad.

“It can be anything you want it to be. This is the nearest we have got to seeing what I would call a universal machine.

Day: May 11, 2010

In-car iPad mounting

Fantastic…

Plus ça change, plus c'est la même chose

And so this morning, the handset maker announced another sweeping overhaul of its management structure, its second reorganization in less than a year.

via Nokia Reorgs Evidently Biannual | John Paczkowski | Digital Daily | AllThingsD.

Apple's Valuation Struggle

I don’t know how many times I can re-write this story but here goes another try.

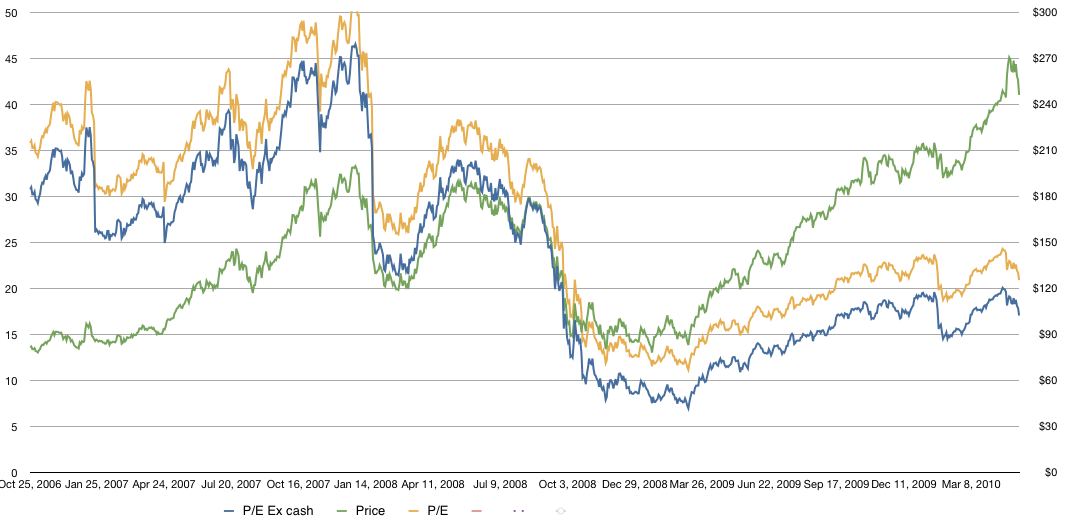

In the graph below I show Apple’s historic share price overlaid Apple’s P/E (with and without cash).

The share price is the line in green with the scale on the right and the P/E (trailing twelve months ex-cash) is shown in blue with the scale on the left. The P/E including cash (which is what is usually cited) is shown in yellow.

As the graph shows, while the stock has risen, the P/E has fallen. This is due to earnings accelerating faster than the stock price. As valuation is usually correlated with growth, it stands to reason that Apple continues to be discounted as a growth stock.

Visualizing iPhone vs Android Shares

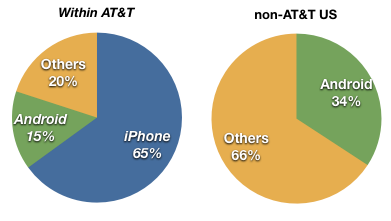

Following up on my last post on how misleading US-only share comparisons can be, I decided to draw charts to visualize the comparison.

As Android and iPhone compete in various ways, it’s hard to see which is the preferred choice given a direct comparison. In other words, iPhone and Android devices rarely are placed next to each other with similar terms.

Take the US market for example. The overall data from NPD suggests that last quarter Android reached 28% share vs. 21% for iPhone. Many of those Android devices were new to market or at least newer than the iPhone which in Q1 was coming to the end of its product cycle. Second, pricing for Android devices seems to have been quite aggressive with buy one get one free sales. But I won’t dwell on tactics now; what I do want to note are the differences in share between AT&T users and non-AT&T.

Note that within AT&T, iPhone outsells Android over 4 to 1. iPhone also outsells “others” (mainly RIM) more than 3 to 1. However, outside AT&T, where the iPhone is not available, Android does not outsell “others”.

Note that within AT&T, iPhone outsells Android over 4 to 1. iPhone also outsells “others” (mainly RIM) more than 3 to 1. However, outside AT&T, where the iPhone is not available, Android does not outsell “others”.

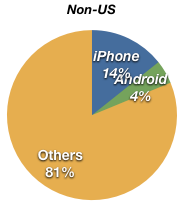

If we exclude the US altogether, we also see that Android does not have a great distribution.

Outside the US, the iPhone also outsells Android nearly 4 to 1, but it has a way to go before challenging Symbian which makes up the bulk of “Others”.

Outside the US, the iPhone also outsells Android nearly 4 to 1, but it has a way to go before challenging Symbian which makes up the bulk of “Others”.

So in markets where Android is head-to-head with the iPhone (AT&T and non-US markets), iPhone’s lead is quite high (still). The possibility still exists that Android will overtake iPhone given the broad licensing and distribution, but it’s not necessarily a given. And in any case, iPhone is not the market share leader today and that leadership does not seem to be their objective (note the pricing).

The bigger question is what will happen to RIM and Symbian as Android grows.