“I would say that the highest abstraction level of the problem is that there are incompetent people managing, ordering or directing things.”

via Rescuing Nokia? A former exec has a radical plan [printer-friendly] • The Register.

Risku believes in the Stupid Manager Theory of business failure. It’s still the overall most popular theory describing why large companies fail. It’s so attractive because it’s so simple.

However, I have several counters/questions to this theory:

- When did management become stupid, exactly? The same group was in charge when the company was successful and the corollary to the Stupid Manager Theory is the Smart Manager Theory for describing company success. So how and when did they become stupid.

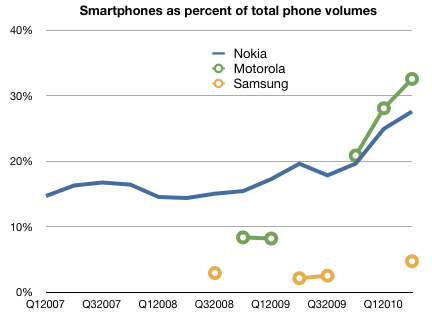

- The conspiracy of simultaneous stupidity. How did *all* managers in a given company become stupid all at once? Did they conspire to lose competence together? Was there something in the water? Didn’t anybody escape the stupidity pathogen? A further observation to be made is that when one company in an industry fails, it’s usually not alone. Motorola, Sony Ericsson and now LG are in dire straits. Is the stupidity contagious across companies? Should we quarantine managers at firms like Samsung that have not yet been impacted? If the stupidity comes from reading market news, should we just keep them ignorant?

- If the managers were always stupid then how did HR get so good at singling out the stupid (or those susceptible to stupidity after periods of intelligence). Isn’t the remedy to simply act in perfect contradiction to their choices and hire only the people that HR rejects. After all, being perfectly wrong is a precious gift.