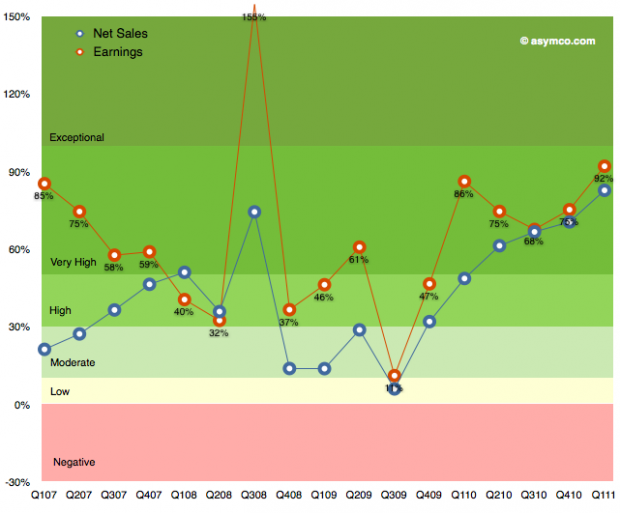

The following chart shows Apple’s growth for net sales and earnings over the last few years. I’ve used a grading system with color coding to show bands of growth.

It’s easy to become de-sensitized to the scope of these numbers, but it bears repeating: the growth has been steadily increasing since 2009.

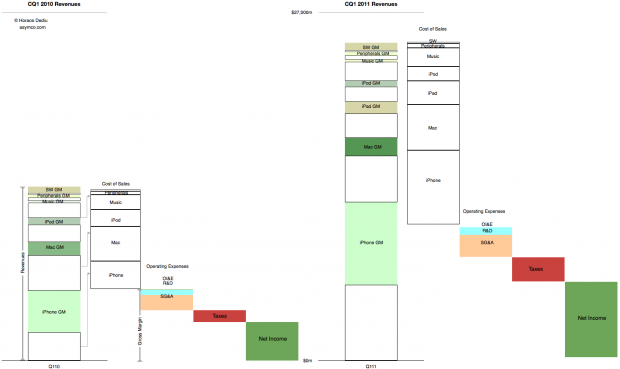

These abstractions in growth can also be shown in a direct “before-and-after” view of the income statement.

This latter view gives an idea of how much bigger the company’s business is now vs. a year ago. Not just on the revenues but also the cost of these revenues and what is retained.

This story never gets old.

Discover more from Asymco

Subscribe to get the latest posts sent to your email.