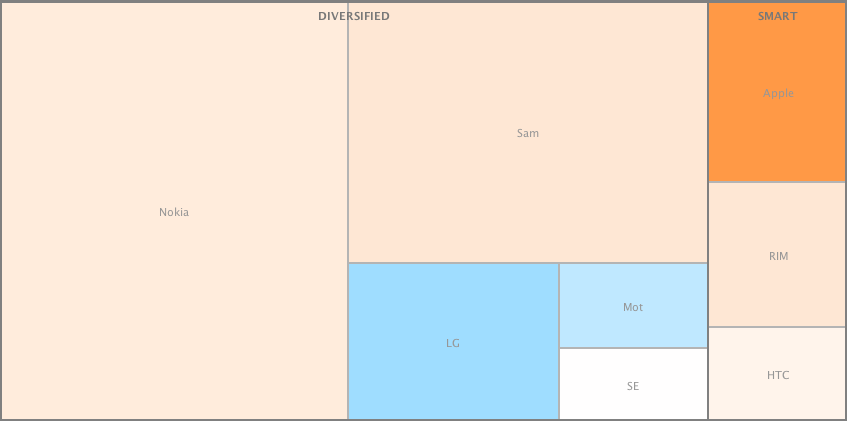

I produced two alternate views of the primary mobile phone brands in terms of volumes sold and operating profit in Q1.

These views[1] allow a comparison by categorized competitors. I grouped dedicated smartphone vendors (SMART) vs. diversified and used color coding for profitability (blue colors indicate loss-making vendors).

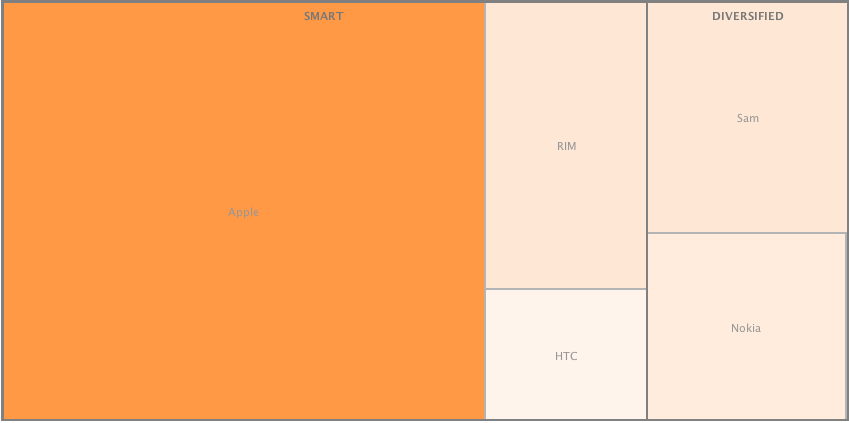

The same view is drawn for profitability. Loss-making competitors are excluded.

This view shows how 16% of the volumes for the smartphone vendors generated 75% of total profits. As smartphone penetration grows, those vendors who maintain a diversified portfolio will continue to see their average price and profitability slide.

I’ve suggested before that I don’t see non-smart devices being interesting to vendors in the near term. Each additional dumb phone added to a portfolio will decrease a company’s operating margin. The market dynamics are such that I think non-smart phones will disappear entirely from branded portfolios in 3 to 5 years.

—

Notes:

- These are called “tree views”. I used Many Eyes experiment from IBM Research to create these charts.

Discover more from Asymco

Subscribe to get the latest posts sent to your email.