There is finally enough information to try to give an estimate of the smartphone market as a subset of the overall phone market.

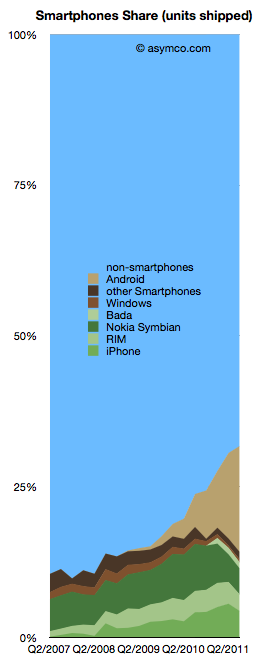

The chart to the left shows the overall picture.

To sum up: The smartphone market has now reached over 30% of shipments. Non-smart devices are at 69% of total. The individual phone platform shares are as follows:

- Android (and Android-like): 17.6%

- iOS (iPhone only) 4.4%

- Nokia Symbian: 4.3%

- BlackBerry: 2.76%

- Bada: 1%

- Windows Phone 0.5%

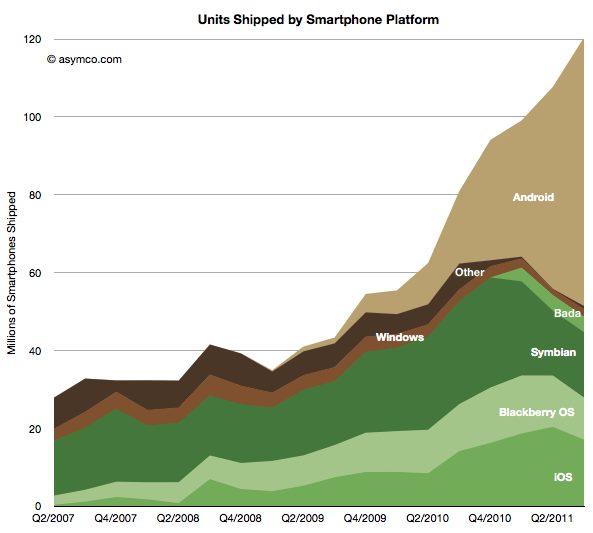

The past quarter was the first where there is evidence of significant non-seasonal decline in incumbent platforms. Both RIM and Symbian saw two sequential drops in volume. The iPhone had a seasonal (or, more accurately, transitional) decline. Windows Phone had a very modest increase in share from 1.3% to 1.7% share though this is well below a margin of error in the estimate.

Android (and Android-like) shipments ballooned to nearly 70 million but sell-through could be about 10 million less. Nearly one in five phones sold is now powered by an Android variant. A remarkable story since the share was zero less than three years ago

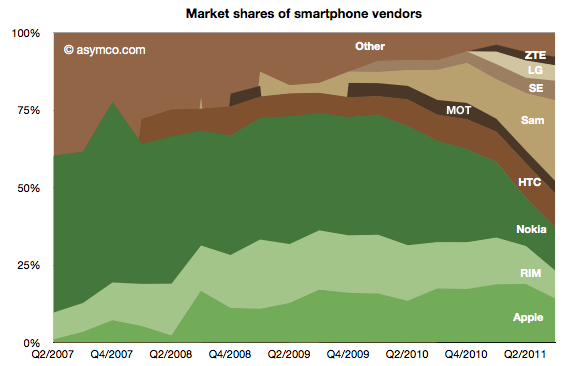

Of the vendors involved, here is the division of share:

Samsung achieved 26% share, nearly swapping share with Nokia over a single year. Nokia reached below 14% while Apple maintained above 14% but down from 19% the quarter prior. HTC overtook RIM with 11% vs. 9%. Sony Ericsson is around 6% and Motorola probably slipped below LG with 4% vs perhaps 5% respectively.

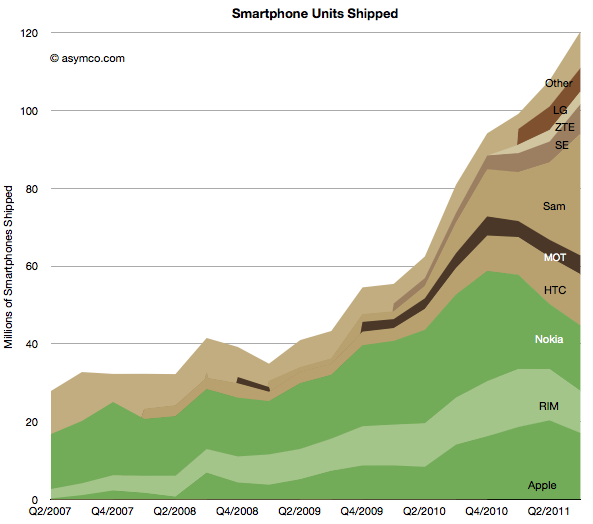

The absolute performance of shipments by vendor and platform follows:

I maintained the historic distinction between integrated (green) and modular (brown) OS strategies to show how the value chain evolved. As Nokia swaps its share to a licensed Windows Phone the share held by integrated vendors is likely to shrink even further.

I maintained the historic distinction between integrated (green) and modular (brown) OS strategies to show how the value chain evolved. As Nokia swaps its share to a licensed Windows Phone the share held by integrated vendors is likely to shrink even further.

Does this mean it’s the end of integration? Or even more importantly, as I have previously suggested the link, is this the end of innovation in the mobile phone market?

It would appear that with 30% smartphone share, the vast majority of phone vendors are ready to abandon any ambition to obtaining extraordinary profits from mobile devices.[1] Apart from Apple, there seems to be complete capitulation to being manipulated by platform orchestrators with unpredictable or opaque intentions.

The thesis of perpetual innovation rules this out. While new input methods offer a clue that visual interaction and the platforms that depend on it are not permanent, the fact remains that cloud computing and the coupling of additional intelligence that comes with it will enable new points of integration and the positioning of these points on new jobs to be done.

Stay tuned as we discuss the future of mobile computing. The best is yet to come.

Notes:

- By extraordinary I mean margins above what a component assembler and distributor would be able to obtain–see the PC industry.

Discover more from Asymco

Subscribe to get the latest posts sent to your email.