I go on and on about Google.

Month: January 2014

The Critical Path #109: Google Ventures

Horace builds on his discussion of Google from the previous episode in light of the Nest acquisition news. We also look at the relatively unreported news regarding China lifting its 13-year ban on game consoles and the variables it introduces to a “big niche” industry.

Invulnerable

On a recent podcast I noted that Google was perceived as invulnerable. In contrast, Apple is seen as temporarily enjoying a stay of execution.1 This is not necessarily a bad thing for Apple. The more gushing the loathing or scorn, the more likely it’s a reaction to love and attraction. A brand dies not from hate but from apathy.

But nor is it necessarily a good thing for Google be be seen as invulnerable. There might be no “Google death knell counter”. There might not be a “Google is doomed” trope. If an executive from Google quits or is fired there is no investor panic. If a product is withdrawn there is no mourning. There are no journalists pursuing Pulitzer prizes by describing some seamy underside of Google. But there are no overt displays of affection either. Google is seen, on balance, as benevolent and hopeful. The discussion on business robustness is simply missing.

I suspect the absence of scrutiny comes from Google being seen as an analogy of the Internet itself. We don’t question the survival of the Internet so we don’t question the survival of Google — its backbone, its index, and its pervasive ads which, somehow, keep the lights on. We believe Google is infrastructure. We don’t dwell on whether electric grids are vulnerable, or supplies of fuel, or the weather(!)

Too complex, too pervasive. These are systems, not things. And people are not designed to contemplate systems. We leave that to experts, or better yet, computers.

The reason Apple is contemplated at all is that it’s not seen as a system. Even the suggestion that Apple is a system is implicitly treated as an impossibility. Because it’s not a system it’s fragile. It’s a person, or an idea, or a product or a singular “key” to something. It is, ultimately, mortal. The only debate is when it will die and points are earned for calling it sooner rather than later.

But what if Apple were a system? And what if Google were a person (or three?)

- The list of Apple Achilles’ Heels is so long and creatively composed that it would take ages to compile, but here are just a few: the Mac (vs. Windows), Digital Rights Management (which kept the iPod alive), dozens of lawsuits (including from The Beatles), the Mac (when it ran Windows), PlaysForSure, Music Labels retaliation, the Zune, Android and clones, the Kindle and Amazon in general, more Mac, iTunes, iPod and iPhone and iPad killers than can be counted; Steve Jobs is ill, Jony Ive will quit, Tony Fadell quit, Rubinstein quit, Forstall was fired, etc. Feel free to add more through comments. See also Apple Death Knell Counter. [↩]

But Apple does not pursue profits either!

In my essay on Google’s absence of profit (or income or business) motives questions were raised on the stated absence of hunger for profits from Apple and what difference there might be from Google’s philosophy.

Indeed, Jony Ive stated:

“Our goal isn’t to make money. Our goal absolutely at Apple is not to make money. It may sound a little flippant, but it’s the truth.”1.

He was probably repeating what Jobs had previously stated:

“I remember very clearly Steve announcing that our goal is not just to make money but to make great products”2

However, note that both quotes are qualified. In the case of Jobs, he said “not just to make money”. Jobs clearly stated that great products lead to money. That great products are causal to money and therefore that if you make great products you make money. One leads to the other.

Ive also continued in this reasoning:

“Our goal, and what gets us excited, is to try to make great products. We trust that if we are successful people will like them. And if we are operationally competent we will make revenue. But we are very clear about our goal.”

I would paraphrase the Apple logic as “Great products are the means by which we sustain our business. By focusing on the product, the customer is satisfied and through that satisfaction we create the free cash flows which can be used to fund more products.”

There is a difference between Apple’s “indifference to money” and the “indifference to business models” that Google exhibits.

Google steps even further away from cash flows. Its goals are to build great things guided by their vision and patterns in the data they collect. The value is in the data itself rather than in any transaction.

As long as the source of money is unfettered, its provenance is uninteresting. A business model is a profit algorithm. It could be linked to the data but it need not be. Markets are messy and imperfect. Data provides much clearer views into value. You could conclude that value itself cannot be trusted to the judgement of the public. Value is to be determined through the recognition of patterns on data privately collected.

So when I say that Google has disdain for market mechanisms I mean that they believe they can do better. Apple still values the user as the ultimate adjudicator of its actions. Google looks past the user and interprets their intentions.

Google sees markets as ultimately obsolete.

The Birth of Silicon Valley

A short anecdote about the history of Silicon Valley told at Asymconf California last year using techniques taught at Airshow workshop.

Next workshop is in San Jose on Jan 30, 2014.

Google’s three Ps

A company is nothing more (and nothing less) than three things: people, processes and purposes. In the language of the software engineer these would be inputs, algorithms and specifications. In the language of classical business analysis they are assets (or resources), organization structures and business models. In military theory, these are logistics, tactics and strategy.

This is the trinity which allows for an understanding of a complex system: the physical, the operational and the guiding principle. The what, the how and the why.

When approaching any analysis problem, these questions form the foundation of causal inference. What is it, how does it work and why does it exist?

When analyzing nature the sciences often help with the what and the how but rarely address the why.1 In contrast, man-made systems (e.g. systems of law, religion and commerce) require an answer to the why as there is a presumption of a will in their creation and preservation. The why allows ultimate judgement on the merit of an enterprise. The why may escape us but it’s assumed to always be there. For instance, in criminal law the motive is often a crucial piece of evidence but it’s not always found. In business, the motive for action or for organization is a crucial piece of the puzzle which often explains the what, who and how, but here the ultimate why is usually profit. This the characteristic of a for-profit business, the purpose is explicit.

Continue reading “Google’s three Ps”

- Religion attempts to answer the whys which science leaves as unanswerable. [↩]

Apple Fourth Quarter Estimates

As Philip Elmer-DeWitt is still interested in my estimates I provided the following:

Revenues ($B) 57.8

EPS ($) 14 (908m shares)

iPhone (units) 56.4 million

iPod (units) 7.6 million

Mac (units) 4.14 million

iPad (units) 26.5 million

iTunes/Software/Services ($) 4.2B

Accessories ($) 2.2B

GM% (percentage) 37.1%

I arrived at these estimates without looking at anyone else’s (except for Apple’s own published guidance). Soon after sending them I noticed that Daniel Tello published his own.

In the same format as above, I quote them for comparison. Please visit his post for additional detail.

Revenues ($B) 59.0

EPS ($) 14.92 (895m shares)

iPhone (units) 56 million

iPod (units) 9 million

Mac (units) 4.65 million

iPad (units) 25.5 million

iTunes/Software/Services ($) 4.3B

Accessories ($) 1.8B

GM% (percentage) 37.8%

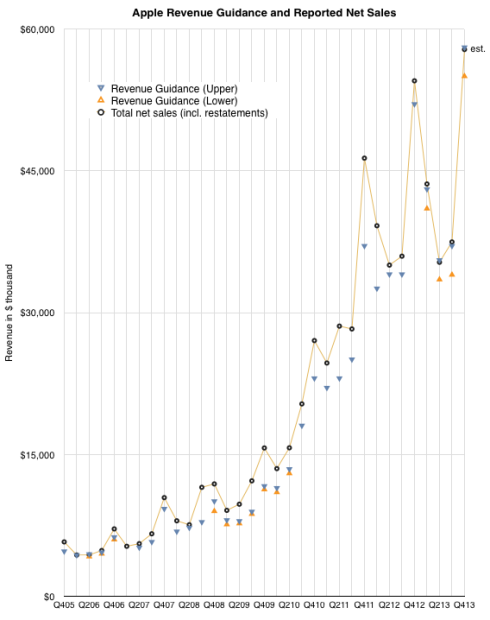

The graph below shows the history of revenue guidance vs. revenue reported. The last quarter shows my estimate for net sales.

Note that the company achieved at or slightly above its upper guidance ever since they started offering a range for guidance (i.e. since Q1 2013). My estimate for sales is therefore very near the top of guidance. The figures for units earnings and margins all result from this assumption.

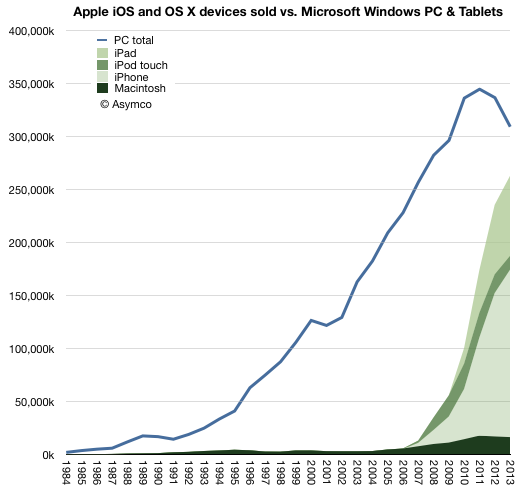

When Apple reached parity with Windows

In 2013 there were 18.8 times more Windows PCs sold than Macs. This is a reduction in the Windows advantage from about 19.8x in 2012. This decline is mostly due to the more rapid decline in Windows PC shipments relative to the more modest decline in Mac unit shipments. Gartner estimates that about 309 million Windows PCs were shipped,1 down from 337 million in 2012 (which was down from 344 million in 2011, the year PCs peaked.) I estimate about 16.4 million Macs were shipped in 2013 down from 17 million in 2012.

The history of PC shipments relative to Mac shipments is shown in the following graph:

I chose to graph the Mac data as an area with additional areas for iOS devices layered on top.

Continue reading “When Apple reached parity with Windows”

- This figure is not published publicly but can be derived from subtracting Mac shipments from the total PC shipments which are published [↩]

Asymcar 9. Stasis: Depreciation, Brands, Information Intransigence

Horace and Jim discuss shopping online for used cars and how and why the value of cars disappears so quickly. The conversation drifts into information asymmetry, the declining interest in auto maintenance and the perpetual closed-loop auto information model. We hypothesize on the impact of the coming self-monitoring and awareness of the lives of vehicles. Finally we ask whether the dysfunction in the industry is the cause or the effect of the ancient integrated factory model and the sustaining auto eco-system incentives that impede transformation.

Asymcar 9. Stasis: Depreciation, Brands, Information Intransigence | Asymcar.

Of bits and big bucks

Exactly one year ago, on January 7th, 2013, Apple announced that the App Store reached 40 billion downloads1. Here are additional data points from that release:

- 20 billion downloads in 2012

- 2 billion downloads in December 2012

- 500 million active iTunes accounts

- 775,000 apps

- sold in 155 countries

- 300,000 native iPad apps

- over $7 billion in developer payments

This year, on January 7th, 2014, Apple announced a new set of data points:

- $10 billion spent on the App Store in 2013

- $1 billion in December 2013

- 3 billion app downloads in December 2013

- 1,000,000 apps

- sold in 155 countries

- 500,000 native iPad apps

- $15 billion in developer payments

The obvious:

- 225,000 apps were added in 2013

- 200,000 native iPad apps added in 2013

- App download rate for December increased by 50%

- No new countries were added in 2013

- $8 billion was paid to developers in 2013 (more than in all previous years put together)

The less obvious: Continue reading “Of bits and big bucks”

- Unique downloads excluding re-downloads and updated [↩]