When tallying up the race to a billion users, I noted that both iOS and Android seem to have the potential to reach that size of user base. However, that raises the question of where those users will come from. We have to note the fact that there aren’t a billion users to be captured today.

When tallying up the race to a billion users, I noted that both iOS and Android seem to have the potential to reach that size of user base. However, that raises the question of where those users will come from. We have to note the fact that there aren’t a billion users to be captured today.

If not today, then how soon, and where are they?

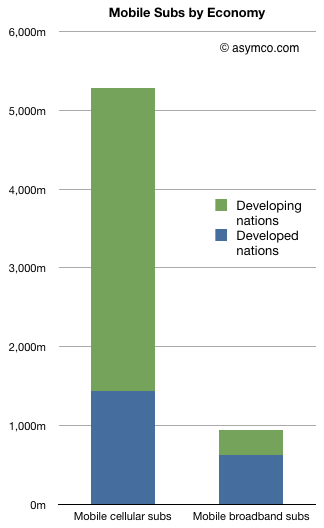

The first question is who is addressable. If we stick with mobile cellular subscribers, there seem to be plenty of users (at least 5.3 billion as of October 2010 according to the ITU). However, the number of “mobile broadband” (i.e. 3+G network subs) is about 940 million. The chart to the left shows the difference and adds the subdivision between developed and developing economies.

Over half (51.1%) of developed nations’ populations have signed up for mobile broadband while only 5.4% of developing country populations are on 3G. And whereas developing countries have added 2.6 billion mobile subs in 5 years, they added only 293 million mobile broadband (MB) subs. Developed nations added 574 million MBs in the same time frame.

As a result, two thirds of mobile broadband subscribers reside in developed nations as of 2010. This number will decrease rapidly as MB penetration reaches saturation in developed countries, however the race to a billion is being run in these markets first.

Which leads back to the question of platform potential. Platforms that target developing nations have the challenge of low broadband availability in the near term in addition to the challenge of device pricing. There are still 800 million developed country subscribers who have yet to upgrade to mobile broadband.

Which leads back to the question of platform potential. Platforms that target developing nations have the challenge of low broadband availability in the near term in addition to the challenge of device pricing. There are still 800 million developed country subscribers who have yet to upgrade to mobile broadband.

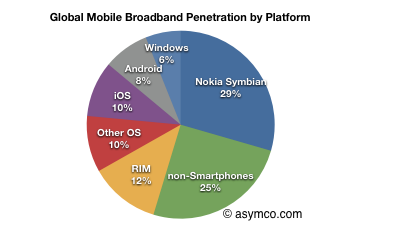

At the time these statistics and knowing the platform sales histories, my estimate is that only 18% of mobile broadband subscribers were using either iOS or Android. 25% were not even using a smartphone and 29% were using Symbian. (See pie chart).

But existing smartphone users are not the most attractive market to target with a new platform device.

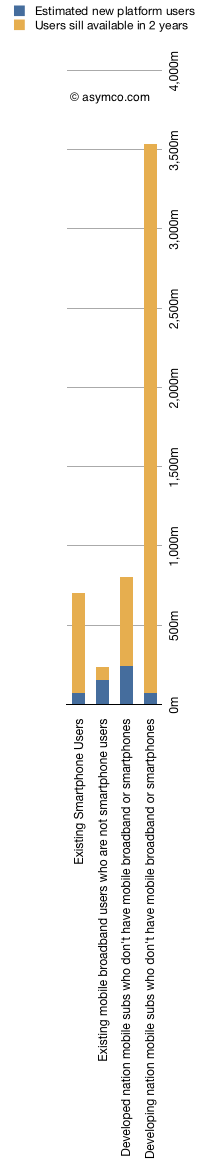

A new smartphone user could come from the following groups of users:

- Existing smartphone users: 700 million. This is tough head-to-head competition for every new user.

- Existing mobile broadband users who are not smartphone users: 240 million. The easiest group to switch to using smartphones.

- Developed nation mobile subs who don’t have mobile broadband or smartphones: 800 million. This seems very attractive since they can be mostly upgraded using subsidized phones into an available 3G network.

- Developing nation mobile subs who don’t have mobile broadband or smartphones: 3.5 billion. This is a very tough market because the availability of 3G will take time and until it appears, the buyers are unlikely to adopt devices that are useful only though a 3G data plan. They are also a difficult market to target with high ARPU phones/plans.

To assess the timing, one could assign some probability weights to these categories to create various scenarios for adoption. My own guess is that the next 500 million smartphone users are easily within reach in the next two years without a significant amount of inter-platform rivalry (See stacked bar chart to the left).

Only after two years will existing smartphone users become attractive for poaching and even that assumes that developing nation networks will still be largely unaddressable.