It’s time to review the mobile phone market at the end of the first quarter of 2011. Before I begin, I’d like to remind that this analysis will span multiple posts and that many details will be published separately due to time and space constraints. Data about platforms, sales, profitability and pricing will be posted separately.

All data sets and chart data will be available for interaction and download through Asymco Interactive when complete. You can purchase a license to Asymco Interactive anytime and you will have access to any new data sets for next 90 days so don’t hesitate to pre-order the report.

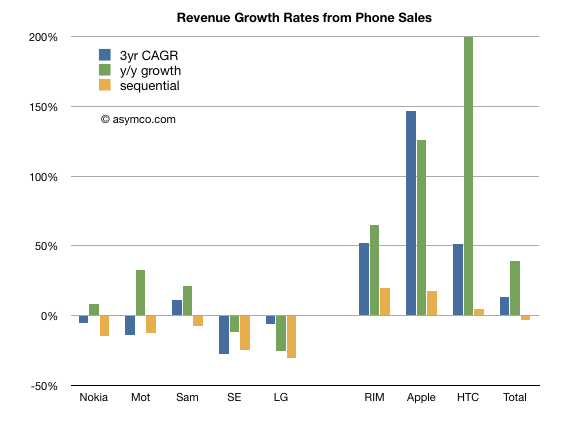

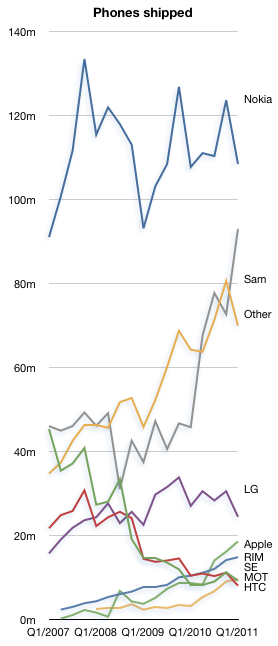

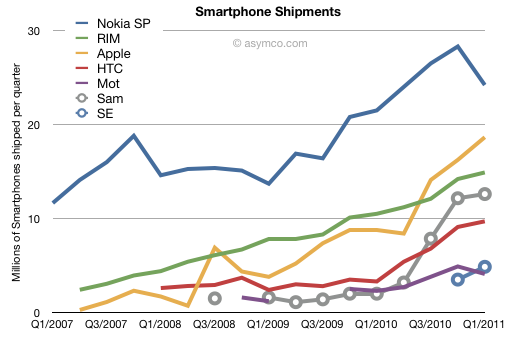

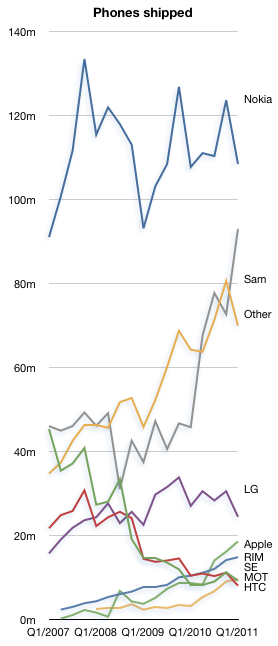

The overall phone market grew at a compound rate of 9% over three years. The pattern of entrants focused on smartphones and mobile computing growing faster than the incumbents continues. The compound three year unit growth for the tracked vendors in descending order is:

- Apple 122%

- HTC 55%

- RIM 50%

- Samsung 15%

- Other 14%

- LG 0%

- Nokia -2%

- Sony Ericsson -29%

- Motorola -30%

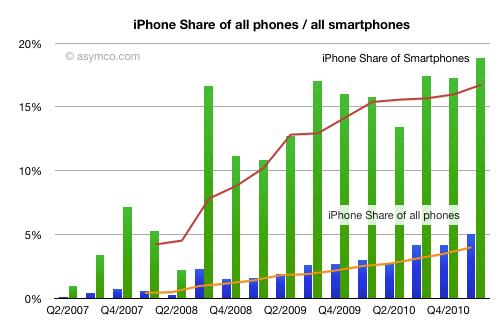

To give an idea of the split between smart and non smart, Nokia’s smart business grew at 18% compounded while its non-smart units contracted at -6% rate.

In terms of y/y growth the market grew at 26% and the vendor ranking is:

- HTC 194%

- Apple 113%

- Other 103%

- ZTE 75%

- RIM 42%

- Motorola 13%

- Samsung 9%

- Nokia 1% (smart: 13%, non-smart -2.3%)

- LG -10%

- Sony Ericsson -23%

Continue reading “The end of phone vendor tiers”