Here were my predictions for the third fiscal (second calendar) quarter from April 25th.

Estimates for Apple’s third fiscal quarter (ending June) | asymco

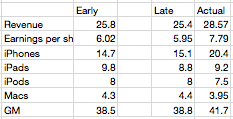

Later in the quarter I updated them for submission to Philip Elmer-Dewitt’s blog at Fortune. The original and updated figures are shown in the following table (with actuals).

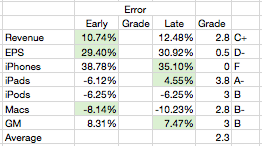

The changes were not significant except in a reduction of iPads. Three items were better in the early call and three were better in the late with one item equal. Using a simple method for scoring the results I gave myself the following report card:

As the Revenue and EPS figures are dependent on the other line items, the most significant error is clearly the iPhone where the error was over 30% (and hence deserves an F). The other figures were not very close either so the overall grade point average is a very mediocre C (2.3).

So, as in previous quarters, nailing the iPhone number is everything. Having failed to guess correctly, the whole performance fell apart.

So how did I manage to get the iPhone number so wrong?

My forecasts depend on a few theories:

- Overall production capacity is increasing at approximately 100%/yr.

- There is significant seasonality due to production ramps as the product is updated on a yearly cycle. These cycles are tuned to reach maximum throughput during the US holiday period. I discussed this theory here.

- Demand is practically unlimited and is throttled by both production schedule and distribution agreements

I successfully applied these theories to the iPhone for over three years and it has always yielded very good (above average at least) results. However, when we reach a point of failure we need forensically consider where the theories failed.

What I suspect happened is that the second theory no longer holds. What I expected was that as the iPhone 4 was reaching the end of its cycle, growth would moderate (as it did last year with the 3GS and we ended up with 61% growth into the last quarter). The reason growth would moderate was that Apple slowed production of the old model in order to switch out to the new model–we saw the same thing happen with the slowdown in iPad 1 and transition to iPad 2.

Instead, what Apple did this year was open the taps on production of the iPhone 4 as it extended its lifetime beyond the traditional 12 months. In other words, the pipeline was not “drained” ahead of a new ramp. Distribution was also boosted with a burst of new operator deals which actually enlarged the pipeline.

So we are witnessing a pivotal moment in the product’s strategy. By slightly lifting off the gas in terms of product cycle, Apple actually set the iPhone loose. The imposition of a yearly cycle on the product coupled with unlimited demand caused it to be artificially constrained.

So I can only reach a conclusion dripping with irony: by stepping off the gas the product actually accelerated.

This phenomenon will allow the company to unleash a wave of unprecedented growth which might claim another theory as victim. Namely, is the limit of 100% growth about to be breached?

—-

Footnote:

A theory approach to forecasting means that you have to stay true to the theory even if there is anecdotal evidence that may suggest you are wrong. If you bend to the anecdotes then you will not learn from failure. If you stick with the theory and ask where it went wrong, you will build a better theory.

Discover more from Asymco

Subscribe to get the latest posts sent to your email.