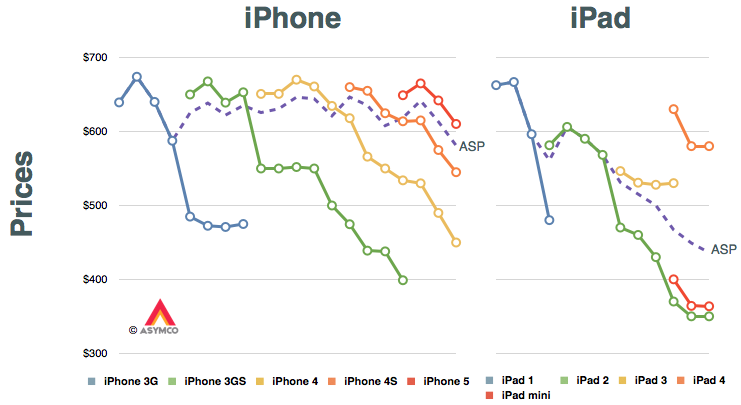

The answer may lie in the way the iPad mini has been marketed. The pattern for iPhone pricing is pretty regular but that for the iPad shows a marked difference. The reason is, of course, that the iPad has already gone through a portfolio broadening. The following graphs tell the story.

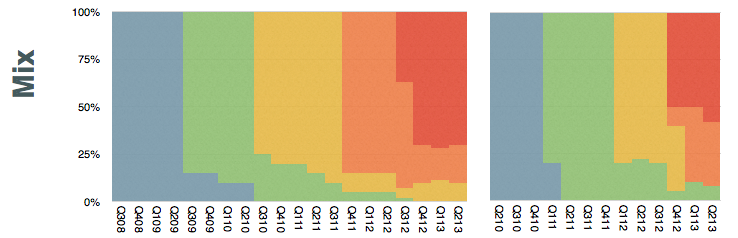

The only data in these graphs that is provided by Apple are the dashed purple lines. They represent the average selling prices (ASP[*]) for the two product lines. I added assumptions about product mix (shown in the lower set of graphs) and thus generated prices for each product variant at a given point in time shown as line graphs.

If you look at the iPad, ignoring the legacy iPad 2 (which I presume sells mostly to educational institutions) the replacement of the iPad 3 was with a “bracketed” portfolio of the higher-priced iPad 4 and the lower-priced iPad mini. Note also that the mini reflects similar pricing to the legacy iPad 2.

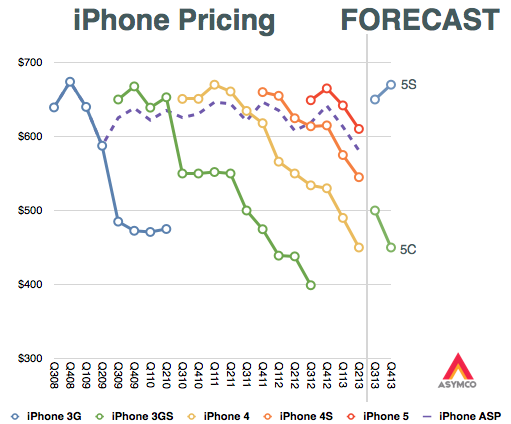

My second assumption is therefore that the 5S and 5C will form a similar bracket as the new iPads did. I also assume that the iPhones 4 and 4S will be retired. This means that the 5C will take up the trajectory of the 4S while the 5S will take up the upper bracket around $650.

The average pricing for the entire portfolio will depend on the mix. This is still highly speculative since we can’t predict how the end-user (operator) pricing will be set for the 5C. Aggressive promotion and new market growth might skew the 5C considerably. On the other hand, upgrade promotions might move the 5S in existing markets.

—

Notes:

- These prices reflect blended average prices of all SKUs to the channel and do not necessarily reflect prices offered to end-users.