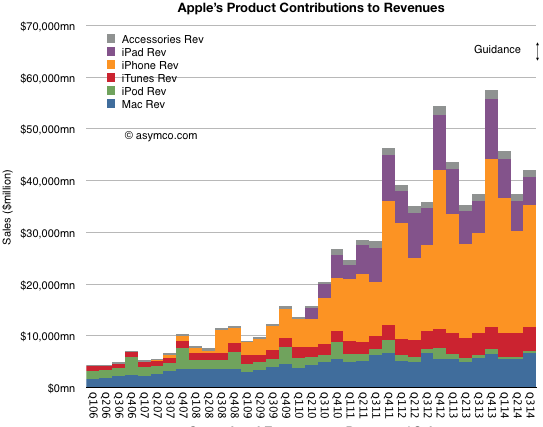

Apple has declared that what used to be “Other Music Related Products and Services”1 plus “Software, Service and Other Sales”2 which was formerly known as “iTunes/Software/Services”3 is about to become “Services”.

“We’ll also have a category that we refer to as services and this will encompass everything we report under the heading of iTunes software and services today including content, apps, licensing and other services and beginning this month it will also include Apple Pay.”

“Services” will therefore encompass a massive amount of revenue. The reported revenues for the fiscal 2014 were $18 billion. Including all billings, the turnover in sales is over $28 billion. For next year, assuming that Apple Pay, which is just getting started, is unlikely to contribute greatly to revenues, Services turnover will top over $35 billion. That figure would make Apple Services alone one of the top 90 companies in the Fortune 500.

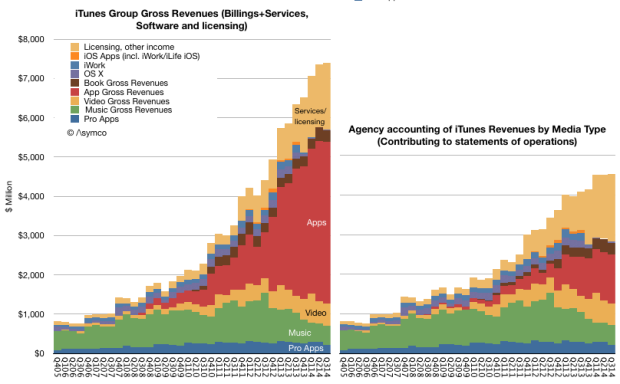

Regardless, as a component of overall sales, the group formerly known as iTunes/Software/Services (shown in red above) was a modest 7% of total sales in the last quarter. Using all available information regarding downloads, payouts and reported financials, an estimate can be obtained on how this 7% is itself divisible into nine sub-segments:

- Pro Apps

- Music

- Video

- Apps

- Books

- OS X

- iWork

- iOS Apps

- Licensing and other income

These are shown above as either contributing to statement of operations (i.e. as reported, on right) or using billings (or the actual “cash register takings”, on left).4

What would be ideal in understanding this Services segment would be to break the “Licensing and other income” into its component parts. Namely:

- Licensing revenues including Google’s payments for traffic acquisition (TAC)

- AppleCare

- iTunes Match

- iTunes Radio

- iAd

- iCloud

- (and soon, Apple Pay)

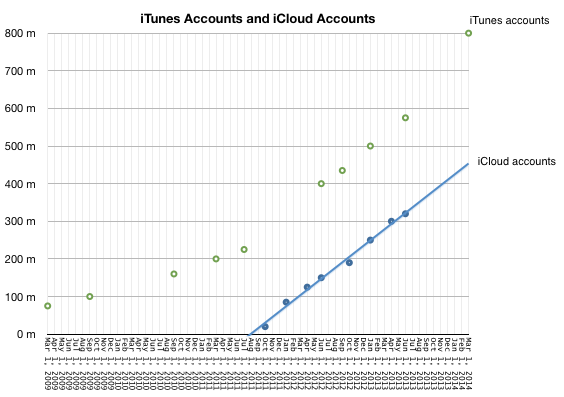

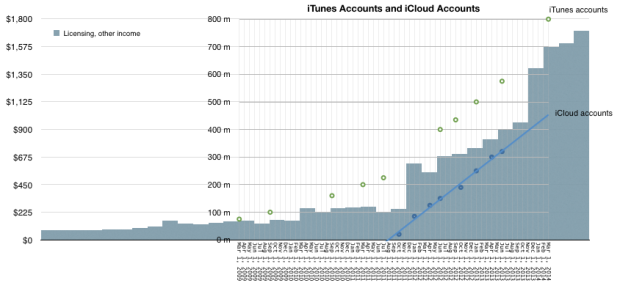

In particular, it would be very interesting to know exactly how much revenue could be coming from iCloud. We have not heard from Apple on iCloud user numbers since mid-2013 and this was the data at the time:

Couple that to “Licensing and Other Income” as deduced from Services accounting yields the following picture:

It would appear that iCloud accounts are growing in proportion to “Licensing and Other Income”. Note that at the point that iCloud accounts were zero, revenues from Licensing were about $225 million/quarter and growing slowly. The real growth kicked in when iCloud accounts started ramping up. Since revenues from iCloud has to be in the “other income” and since no then it is, I believe, reasonable to assume that the iCloud user base growth is a principal driver of growth5

Also, bursts in the Licensing and other income line occurred after several iCloud-specific marketing events:

Mobile Me migration started in October 2011 and on September 30, 2013 the complimentary iCloud storage plans expired and were automatically adjusted to the free 5 GB plan (with an offer to upgrade to a paid plan). Correspondingly, Q1 2012 and Q1 2014 showed the largest increases in Licensing and Other Income.

This is a multiplication of many assumptions, but there is some intuitive logic. The only place iCloud can be found seems to be growing in proportion to iCloud users and plan marketing.

So how much does iCloud contribute to Apple’s sales? My guess would be about $1 billion per quarter. That would be spread over 500 million iCloud accounts and therefore an average revenue per account of $2/user/quarter or $8/user/yr.

The lowest non-free iCloud pricing is about $12/yr (5GB plan is free). This would imply that two thirds of iCloud users are paying users (and one third are opting for the 5G plan).

I realize that this attach rate to a paid service is astronomical. Anything over 10% is unheard of. I would say the error in my estimates could be 20% but that still leaves a huge gap to what seems reasonable.

[Put another way, if the attach rate were only 10% then iCloud revenues would have to be in the $600 million range and thus only about 10% of what Licensing and Other income seems to be. This would force the question of what could be generating the remaining $5.6 billion/yr.]

- Includes revenue from sales from the iTunes Store, App Store and iBookstore in addition to sales of iPod services and Apple-branded and third-party iPod accessories. [↩]

- Includes revenue from sales of Apple-branded and third-party Mac software, and services. [↩]

- Includes revenue from sales on the iTunes Store, the App Store, the Mac App Store, and the iBooks Store, and revenue from sales of AppleCare, licensing and other services [↩]

- The primary distinction is in Apps billings where the 70% paid to developers is not shown as revenue. [↩]

- Of course, AppleCare could also be a driver but AppleCare should follow overall device sales patterns and this is not clearly evident in the Licensing/Other curve [↩]