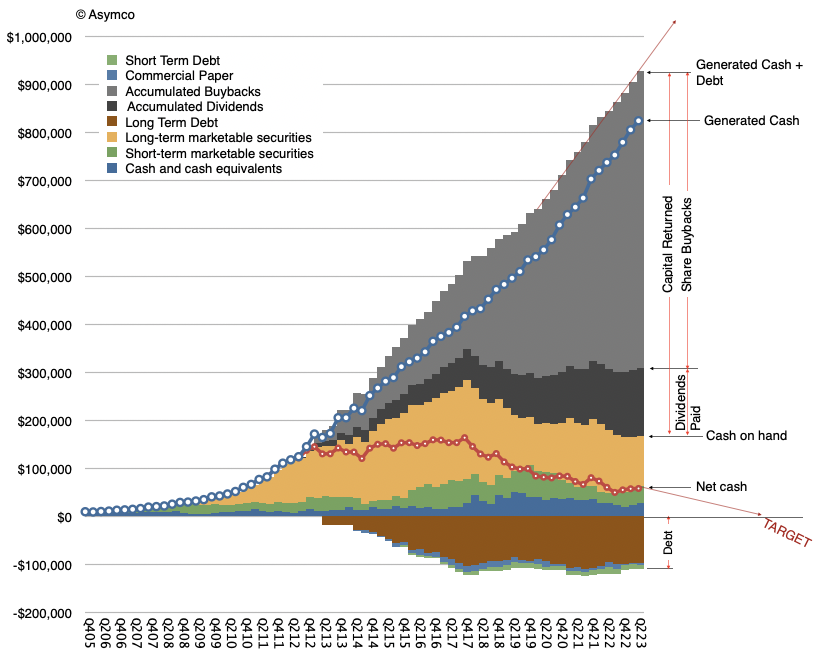

Apple has so far returned $761.5 billion to shareholders. 143.3 billion in accumulated dividends and $618.2 billion in share buybacks. These are the gray areas in the graph above. The question that often comes up is: isn’t this capital return program a misallocation? In particular isn’t buying back shares and retiring them a waste of money?

By definition, it cannot be. The mechanism of buying shares and retiring them is a process of returning retained capital to shareholders. The other ways this can be done are through dividends (periodic or one-time) or the sale of the company (liquidation). Ignoring the liquidation option which does not make sense for viable companies, the decision between dividends and buybacks comes down to a tax efficiency question.

The result is, however, roughly the same: retained earnings, which are stored by the company as cash typically (net value for Apple today is $57.2 billion), are an asset balanced by a liability to the shareholder called Total Shareholder Equity (valued today as $60.3 billion.) As such, the retained earnings belong to the shareholders. It’s why they own the company. It’s what their cash share of the value in the company is.

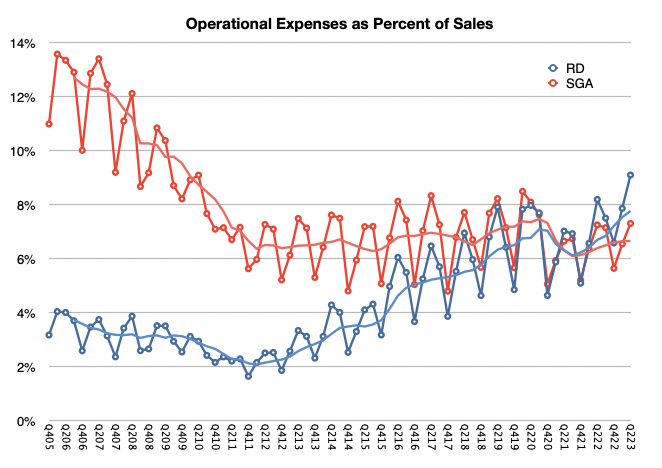

It’s also surplus to the company’s needs. Had the company needed this cash, it would have spent it on building the products and services it sells or operations that maintain or grow the business. Those expenses appear in cost of sales (COS) or cost of goods sold (COGS) or in operating expenses Sales, General and Administrative (SG&A) or Research and Development (R&D). If it’s not spent this way then it drops to the net income line and, crucially, is subject to taxation (about 12% to 15% for Apple). After taxation, once returned, it’s taxed again as either capital gains (in the case of buybacks) or dividend income. These rates vary on the jurisdiction of the owner and the current tax policy.

Note that the spending on R&D includes development of future projects which are not directly related to current products. Engineering of current products is expensed against COGS. R&D for Apple ($29.4 billion in last 12 months) is significant, having grown to 9% of sales, as the graph below shows.

For the company to decide to return capital it really does mean that it has no good ideas on how to spend it given what the company knows it can and cannot do. It’s a judicious decision and one which honors the relationship between owner and manager with fiduciary responsibility to the owner.

Still, doesn’t that mean it’s wasted?

No. Giving it to the shareholder means that the company says “It belongs to you, I don’t know what to do with it on your behalf, so here, you figure out what to do with it.” The shareholder can then make an allocation decision that suits their sense of what is valuable or useful. The return is a deferral of decision to the owner rather than their agent.

To the extent that once returned, the capital is misspent, that is on the spender, not on Apple.

Consider the alternatives. Instead of returning capital, what some managers decide to do is to re-allocate those retained earnings to acquire other companies with the promise of value creation through synergies. However these are often huge wastes of money. The new asset is recorded as “goodwill” on the balance sheet, offsetting the retained shareholder equity. As the synergies fail to materialize, the asset (goodwill) is written off, and shareholder equity decreases accordingly, and so, value evaporates or is transferred to the owners of the acquired company who cash out above market value.

Acquisitions are a process of picking the pocket of shareholders.

The alternative might be to spend heavily on R&D. That is more admirable but the amount involved is enormous and it’s very difficult to find enough people and projects worth pursuing without turning R&D into an academic organization. Remember that with R&D at $7.4 billion per quarter, the company is spending 41 times more than it did in 2006.

And doubling or tripling R&D, even if possible, would impact margins to such an extent that Apple’s profitability would show very poorly indeed. That would collapse share prices and decrease share-based compensation, limiting the possibility of recruiting talented engineers. It would bring quite a lot of negative consequences.

Another exercise to undertake would be to ask what would happen if the mechanism of share buybacks were made illegal. It was not always legal anyway. That is left as an exercise to the reader.

Discover more from Asymco

Subscribe to get the latest posts sent to your email.