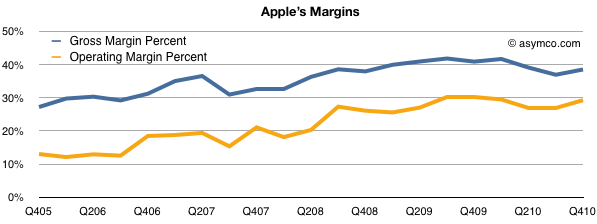

As the highly profitable iPhone makes up an increasingly larger proportion of Apple’s sales, the overall gross margin would be expected to grow.

Sure enough that’s what’s been happening.

The gross margin percent, which measures the direct or variable costs of production vs. price, shows a healthy rise in the last five years from slightly below 30% to around 40%. The Operating Margin, which also includes the overhead or fixed costs like R&D and SG&A, shows a similar rise, reaching about 30%.

Margin expansion while sales quadruple is a good indicator that a company is producing real value not just trading sales volume for profit.

Continue reading “iOS enables 71% of Apple's profits. Platform products power 93% of gross margin”