Motorola—like HTC—is thus a bellwether for makers of Android phones, whose sales have now caught up with those of the iPhone—about 300,000 a day worldwide. Some industry analysts doubt that it will be able to create a big market for its devices and make enough profits before cheaper providers move in. If they are right, the smartphone market may eventually become like that for personal computers: a handful of huge competitors with tiny margins. The difference will be that these firms will hail from around the world rather than being mainly American.

via Motorola: Breaking up | The Economist.

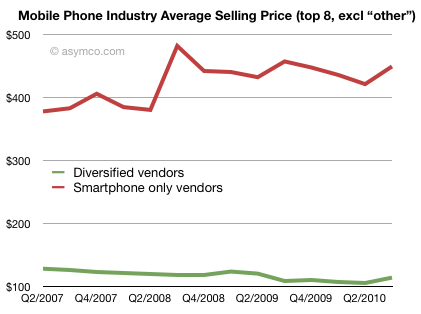

When I argued that the meek shall inherit Android, the profitability data was the core evidence. That argument, made in August, was:

So here we have the real challenge to Android: partnership with defeated incumbents whose ability to build profitable and differentiated products is hamstrung by the licensing model and whose incentives to move up the steep trajectory of necessary improvements are limited.

In other words, Android’s licensees won’t have the profits or the motivation to spend on R&D so as to make exceptionally competitive products at a time when being competitive is what matters most.

The surge in emerging market Android entrants has been the latest setback for branded Android vendors. What should be the long term strategy for companies like Motorola and Samsung? Continue reading “Resetting Motorola”