Author: Horace Dediu

Apples vs. Nokia in North America

Comparing US sales of iPhones vs. Nokia’s NA device business.

AT&T iPhones activated in Q3: 3.2 million

Nokia phones sold in North America Q3: 3.1 million

(obviously, Nokia’s figures include Canada and Apple might have sold a few more phones in the US than AT&T activated so Apple outsold Nokia by a significant margin in units in the US.)

Market Caps

For reference, some selected current market caps:

- Microsoft (MSFT) – $236.76B

- Apple (AAPL) – $183.40B

- Google (GOOG) – $173.97B

- IBM (IBM) – $159.93B

- Cisco (CSCO) – $138.60B

- Hewlett-Packard (HPQ) – $114.26B

- Intel (INTC) – $109.85B

- Disney (DIS) – $54.31B

- Nokia (NOK) – $48.24B

- Research In Motion (RIMM) – $37.43B

- Amazon (AMZN) – $40.34B

- Dell (DELL) – $29.63B

- Sony (SNE) – $29.10B

- Yahoo! (YHOO) – $24.78B

- Motorola (MOT) – $18.82B

- Adobe (ADBE) – $18.23B

- Palm (PALM) – $2.51B

- RealNetworks (RNWK) – $564.74M

The top 10 world-wide:

- Exxon Mobil Corporation 352.31B

- PetroChina Company Limited (ADR) 240.47B

- Microsoft Corporation 237.58B

- Petroleo Brasileiro SA (ADR) 220.19B

- BHP Billiton Limited (ADR) 204.30B

- HSBC Holdings plc (ADR) 199.98B

- China Mobile Ltd. (ADR) 199.09B

- Royal Dutch Shell plc (ADR) 195.76B

- Wal-Mart Stores, Inc. 195.27B

- Apple Inc. 183.57B

Steve Ballmer is not worried, Apple is just a rounding error.

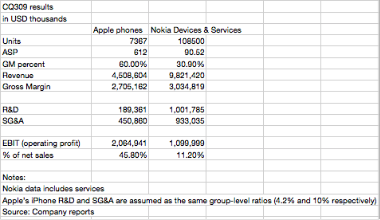

Apple vs. Nokia on Profitability of Devices

Peugeot Renault and Citroen

I’m trying explain the complete lack of interest in Nokia among the US blogging/early adopter audience. If you are an enthusiast, why do you not care about the market leader. The automotive analogy is not quite perfect, but there are brands that are just invisible to the community even though they are quite popular and significant.

I’m trying explain the complete lack of interest in Nokia among the US blogging/early adopter audience. If you are an enthusiast, why do you not care about the market leader. The automotive analogy is not quite perfect, but there are brands that are just invisible to the community even though they are quite popular and significant.

The French have a pretty crap reputation and it’s not entirely undeserved, however what’s worse than being talked about badly is not being talked about.

You Can’t Touch This

Apple’s Q4 2009 conference call revealed that iPod touch sales were up 100% year over year. For the full fiscal year, iPhone grew 78%.

Tim "Corleone" Cook

When asked more pointedly, “So when you go from exclusive to multiple, you don’t change the charge to the carrier?” Cook answered, “Correct.”

Apple has more pricing power than the Don.

iPhone Money Trail

Peter Oppenheimer, Apple’s Chief Financial Officer, said that the Average Selling Price of iPhones in the quarter “was just over $600. This reflects both high mix of 3GS sellthrough and benefits of rebalancing the ending channel inventory toward the 3GS.”

An astonishing admission from Apple who has never revealed their iPhone ASP. Previous analyst estimates had the iPhone ASP at $550. If this is true, then Apple has violated one of the cardinal mobile industry rules: “Thy ASP shall always erode”. Given what is known about the components, iPhone gross margin is likely to be above 50%. The gross margin, or what you are able to capture in value above the bill of materials, isthe primary indicator of value creation in the device business. Apple’s number is astronomical vis-a-vis the competition. Stay tuned as this gets scrutiny.

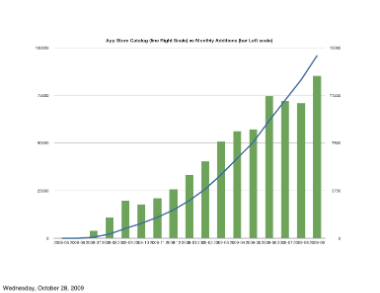

100k Apps

On Units and Platforms

When thinking about the number of devices shipping out of Apple, and the relative value of those units compared to the competition you have to always think of the platform.

When thinking about the number of devices shipping out of Apple, and the relative value of those units compared to the competition you have to always think of the platform.

The market leader Nokia claimed to have sold 16+ million smartphones in the quarter. When comparing platforms, to whatever Apple ships in iPhones you have to add the iPod touch units. I see that number being about half of the iPhone numbers or about 4 million. Let’s say 10 to 12 million as a range for the platform. Already this is within striking range of Nokia.

It may sound that Apple has some catching up to do, however the important thing is that most of the Nokia devices are not uniformly addressable by developers because they are different platforms and the Symbian platform itself will be broken next year as it has been broken many times before. This is also true for Blackberry and Windows Mobile and will become true for Android as vendors fork and splinter the code to differentiate.

This already puts Apple in the pole position today in terms of contiguous addressable units volumes.

I cannot over-emphasize the importance of this platform effect. It’s what made Windows dominant and it should be the most important issue in the planning of new mobile products, but it clearly isn’t for Apple’s competitors. Either product planners are ignorant of history or completely hamstrung by other constraints on their businesses (I expect the latter).

As a result it’s inevitable that Apple will have a dominant platform. The numbers in apps and consumption of apps already are telling this story, and devs are voting with their code in a landslide. But going into 2010, this will become evident in the units and Apple share numbers will accelerate toward lead position.

The bogie therefore is to look for contiguously addressable installed base. On this basis of competition, I expect at least 100 million for Apple at the end of next year and less than 10 million for any competitor. At that point the game will be officially over.