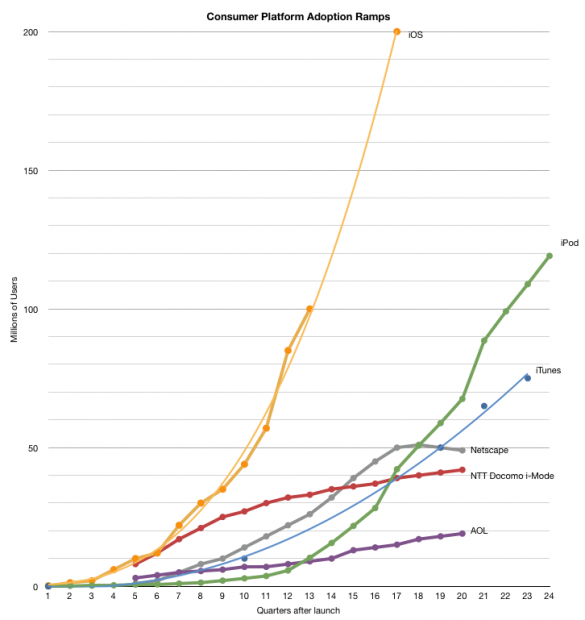

As iOS crosses 100 million units sold 3 years after the platform launched, it’s time to look forward to the next 100 million. My expectation is that well over 100 million iOS devices will sell during 2011, but even during the next 12 months (2H ’10 and 1H ’11) the total may well reach 100 million, making 200 million installed by June 2011 very likely.

Here is where the numbers will come from:

iPhone: Assuming only 50% growth (half of the average growth seen so far) gives 50 million units in the next 12 months.

iPad: 15 million base assumption

iPod: This is the most difficult to predict, but 46 million iPods will sell with a growth rate of -8% to -9%. If we consider the iPod touch part of the mix to be 40%, we get 19 million.

The total with these assumptions would be 84 million. A slightly higher growth rate for the iPhone would easily push the total to 100 million.

200 million devices in four years is quite a feat. Compare it to the growth of television which reached 50 million Americans in the first decade after commercial launch. Or consider the Netscape browser which only reached 50 million in its first four years or AOL which just crossed 20 million or in Japan where i-Mode reached 40 million users in the same time frame.

At 200 million, the iOS platform will be 18% the size of the world-wide television audience.