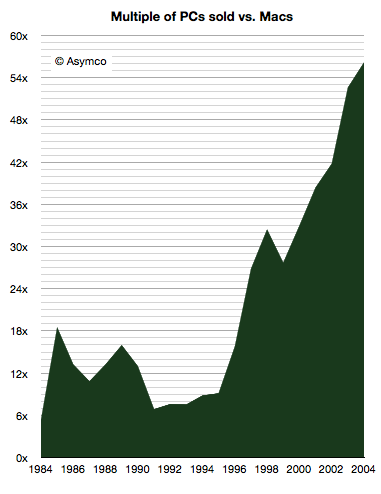

When the Macintosh was launched in 1984, computers running the MS-DOS operating system were nearing a dominant position in the market. Having launched in 1981 as the IBM PC, they were quickly cloned and four years later “PCs” were selling at the rate of 2 million/yr. The Mac only managed 372k units in its first year.

When the Macintosh was launched in 1984, computers running the MS-DOS operating system were nearing a dominant position in the market. Having launched in 1981 as the IBM PC, they were quickly cloned and four years later “PCs” were selling at the rate of 2 million/yr. The Mac only managed 372k units in its first year.

In other words, PC was outselling the Mac by a factor of nearly 6. It turned out to be a high point. The ratio by which the PC outsold the Mac only increased from there.

When Windows 95 launched in 1995 it negated most of the advantages of the ease of use of the Macintosh and the PC market took off. The ratio reached 56 in 2004 when 182.5 million PCs were sold vs. 3.25 million Macs.

During the second half of the 90s it was already clear that Windows won the PC platform war. Windows had an advantage that seemed unsurmountable.

I should point out that this ratio between platforms is not just an exercise in arithmetic. It’s a measure of leverage. The advantage of dominance is realized in an ecosystem which creates lock-in and additional economies in marketing. Ecosystems become self-perpetuating and there is a tendency toward monopoly. The stronger you are, the stronger you get.