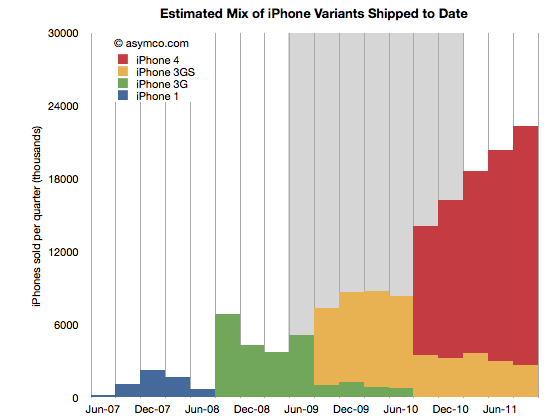

Last quarter I was wrong because I thought Apple would throttle production of the iPhone 4 in the fourth quarter post-launch. “The reason growth would moderate was that Apple slowed production of the old model in order to switch out to the new model–we saw the same thing happen with the slowdown in iPad 1 and transition to iPad 2.”

As a result I seriously under-estimated iPhone volumes in the second quarter (FQ3). That failure led me to question whether the theory I was using in forecasting was still valid. When it came time for a new estimate I hesitated.

As a result I seriously under-estimated iPhone volumes in the second quarter (FQ3). That failure led me to question whether the theory I was using in forecasting was still valid. When it came time for a new estimate I hesitated.

I had to choose whether to apply the old seasonality theory or to assume that the game had changed and that the product would now grow organically.

The first assumption would put the iPhone growth at 100%+ while the second would place it in the 60% to 80% range. I decided to dial in a figure somewhere in between at 90% but I’m not very confident in this

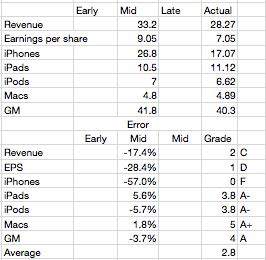

The result was an over-estimation by almost the same error as that of the previous quarter. Most of the other product lines were accurately predicted, but again, as a always, the whole forecast rides on the iPhone.

So where does that leave the theory? Continue reading “How did I get the iPhone number so wrong (part II)”