On October 4th, Tim Cook will take the stage at Apple’s fall event. With Steve Jobs’ transition to head the Board of Directors of Apple and after serving as CEO for fourteen years, it is time to take a look at his reign.

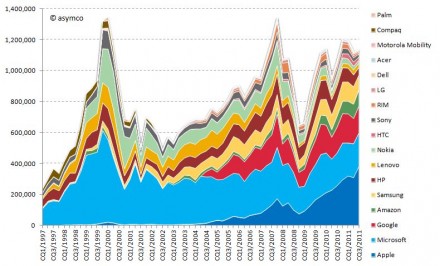

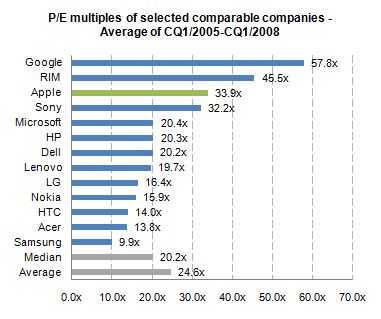

Looking at his performance vs. peer companies from a capital market performance, I have composed the following two charts:

Market capitalization of selected peer companies by calendar quarter in USD million sorted by most recent market capitalization (1997-2011)

Market capitalization as share of combined market capitalization by calendar quarter sorted by most recent market capitalization (1997-2011) Continue reading “Visualizing the Steve Jobs era”