A month ago I wrote an exposé on the problems I felt Verizon was facing with their smartphone strategy: Verizon Strikes Out in Smartphones [Updated]

Given new information on subscriber growth and the relationship between Verizon and Apple, it’s time to look back and assess how the conclusions are standing up.

The conclusions I drew were that Verizon had three strikes against them:

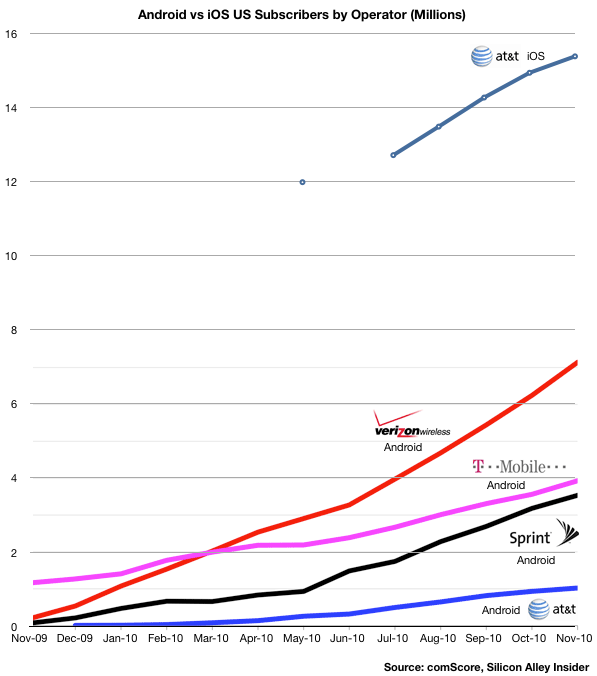

- The iPhone has stolen their growth

- They are facing the prospect of a single OS platform supplier

- Android is not competitive vs. iOS

Did iPhone really hurt Verizon?

Continue reading “Verizon back at bat: Revisiting the last inning”