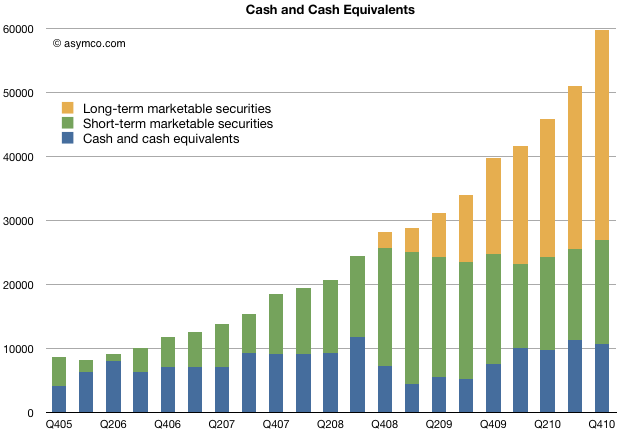

The following chart shows the value of Apple’s cash and cash equivalents for end of 2010:

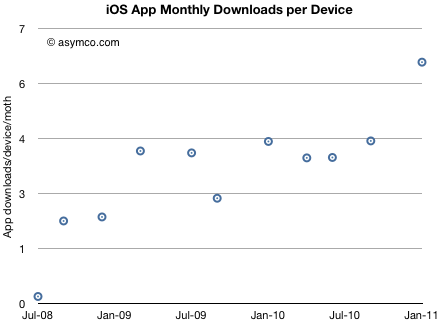

iOS users download about 5 apps every month

Thanks to a reader for asking this question: “Wouldn’t it be more telling to look at the monthly rate of downloads / device at any given time?”

Yes it would.

Here’s what can be derived based on download rates and installed base of devices.

Continue reading “iOS users download about 5 apps every month”

The Cook Doctrine

We believe that we’re on the face of the Earth to make great products, and that’s not changing.

We’re constantly focusing on innovating.

We believe in the simple, not the complex.

We believe that we need to own and control the primary technologies behind the products we make, and participate only in markets where we can make a significant contribution.

We believe in saying no to thousands of projects so that we can really focus on the few that are truly important and meaningful to us.

We believe in deep collaboration and cross-pollination of our groups, which allow us to innovate in a way that others cannot.

And frankly, we don’t settle for anything less than excellence in every group in the company, and we have the self-honesty to admit when we’re wrong and the courage to change.

And I think, regardless of who is in what job, those values are so embedded in this company that Apple will do extremely well.

– Tim Cook, Acting Apple CEO, January 2009 FQ1 2009 Earnings Call

See also: Apple vs. Exxon-Mobil

How long before apps overtake physical video game content sales?

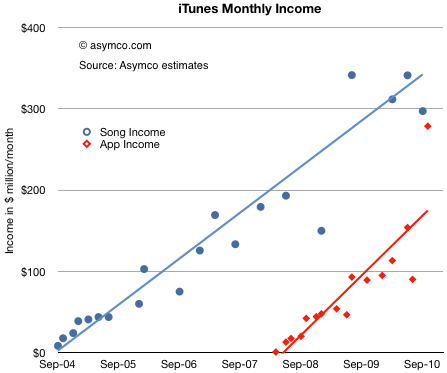

After reviewing the payments to suppliers, we can look at the store’s revenue generation rate. With the same assumptions, we have the following chart:

We will have to wait for another report to see whether the recent burst of volume from apps is sustained[1], but the trend shows income from apps narrowing the gap to music. Continue reading “How long before apps overtake physical video game content sales?”

iTunes has paid over $2 billion to app developers and $12 billion to record labels

The last analysis of the iTunes content store showed amazing acceleration in download rates. Since we know something about the pricing of apps in aggregate, we can make some guesses about the income from apps for both Apple and suppliers.

The key assumptions are:

- Average selling price per app $0.29 (as reported in June 2010 here).

- Price per song $.99 increasing to $1.05 over time

- Music gross margin 10%

- App gross margin 30%

The first chart shows the accumulated payments made to suppliers of content to the iTunes store over time. Continue reading “iTunes has paid over $2 billion to app developers and $12 billion to record labels”

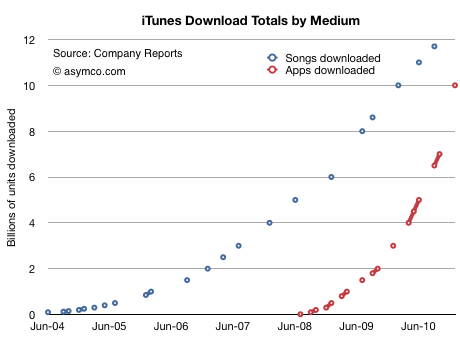

More than 60 apps have been downloaded for every iOS device sold

The iTunes App Store is about to reach 10 billion downloads. That makes this a good time to revisit app growth metrics and compare them with the other digital media store that we have data for: the iTunes Music Store.

First, the download totals as time series[1]:

Continue reading “More than 60 apps have been downloaded for every iOS device sold”

What Google can learn from John Sculley: How technology companies fail by placing their strategy burden on technology decisions

And so we come to the question of Chrome and H.264. First off, it should be clear that video codecs are infrastructural technology[1]. They are commodity algorithms which are generally invisible to users. They are ubiquitous and are “shared” in the sense that they are available for licensing often without much in terms of cost.

So they don’t really offer strategic advantage to the adopter. Some may end up adding slightly more to a cost structure than others, but not in a way that determines strategy.

Flash on the other hand is not infrastructural. It is not shared, it is not invisible to users, it is a brand, it has a significant business model and market value. It is sustaining to Adobe.

So the argument I’ve heard against Google’s decision is that they are using an infrastructural technology decision (a new video codec) to placate or sustain Adobe Flash, at the expense of Apple, a potential or perceived rival.

If this was the plan, it would be a strategic mistake. Continue reading “What Google can learn from John Sculley: How technology companies fail by placing their strategy burden on technology decisions”

Is Android more efficient than iOS at generating search revenue?

Thanks to David Chu for forwarding the data that made this possible and reader Narajanan for spotting the divergence in platform efficiency.

iOS and Android are both growing rapidly. According to Gartner, during the first three quarters of 2010, about 44 million iOS devices and 36 million Android devices were put into use. That’s 80 million devices. An amazing achievement for two platforms that did not exist 3 years earlier.

But obviously not all devices are used the same way. Devices which have unused capabilities limit network effects for a platform and for the category of product in general. Question is: how can we measure the “smartness” of a device; how much more likely is a device to be used as a mobile computer vs. being a regular phone?

The best proxy I can think of is a measurement of browsing use. Continue reading “Is Android more efficient than iOS at generating search revenue?”

Big in Denmark: iPhone captures 36% of phone market value

Thanks for Rob Marsh for forwarding the following snapshot of data from Denmark:

Salget af smartphones eksploderer i Danmark.

According to GfK data in Denmark, during the first quarter of 2010 29% of phones sold were smartphones. In the second quarter, the share grew to 37%. In the third quarter, 51% of units and 71% of sales value was captured by smartphones.

Looking at September alone, Apple’s share of the smartphone market was 34%. In terms of value share, 51% of all the dollars that consumers spent for smartphones, was spent on the iPhone.

In other words, Continue reading “Big in Denmark: iPhone captures 36% of phone market value”

Remembering January 14, 2008: The day the market lost faith in Apple

In a recent but recurring lament I asked why Apple shareholders are not being rewarded for the company’s growth. I pointed out that there is no fundamental reason why the company should receive such a low P/E multiple (about 18 ex-cash trailing and 10x forward while maintaining 70% earnings growth for over a year).

There were many objections in the comments. Most of them dealt with recent reasons why doubts might have arisen among investors: Android hegemony or some perceived lack of competitiveness leading to margin compression or some macro hangover from the recession.

In this article I argue that none of these objections hold water. My argument hinges on the fact that there is a precise date when Apple ceased being seen as an exceptionally valuable company and that date precedes any of the causes being suggested.

The day of disillusionment was almost exactly three years ago: January 14th, 2008.

Continue reading “Remembering January 14, 2008: The day the market lost faith in Apple”