Horace proposes a classification of analysts and their motives and how to think about the value of commentary. We delve into how Apple executives obtain and preserve authority and talk about the disruptive impact of Nintendo. Also a hint about a new Perspective presentation before WWDC.

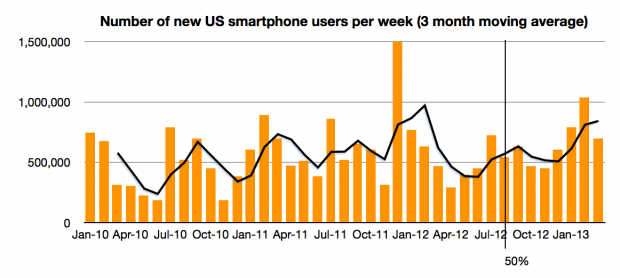

Measuring Platform Churn

The latest comScore data shows consistent growth in US smartphone penetration. The rate is now 58.4% of adult consumers who own phones. This is up from 20% only three years ago. The rate of growth remains a remarkable 1.2% per month. That’s 700,000 new-to-smartphone users every week. The historic average over 3 years has been 1.07%/month This after having crossed over 50% on schedule in August 2012. There appears to be no slowing.

The next milestone I have pencilled in is the 80% mark which I extrapolate to be achieved by October 2014. 80% could be considered “saturation” which would signify a rapid slowing of new user addition. However, that might still not happen until 100%, depending on the availability (or lack thereof) of non-smartphones to buy.

Martin Bryant of The Next Web Interview

“So paradoxically, the opinion of those who are highly paid should be treated with suspicion while the opinion of those subject to peer review should be treated with respect. It brings to mind the difference between highly paid fortune tellers and pundits whose methods are obscure vs. poorly paid graduate students whose methods are open to all. Whose opinion is worth more?”

To read more see Horace Dediu on the bad habits of Apple analysts and why Tim Cook shouldn’t be fired – The Next Web

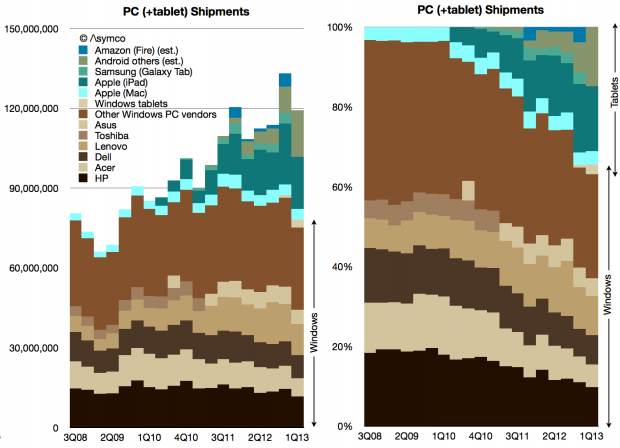

Surface Tension: The effect of Surface on Windows revenues

According to Strategy Analytics 3 million Windows-based tablets shipped in Q1. That is not inconsequential. It would add 4% to the total Windows-based computers and reduce the decline in Windows PC growth to -8% (from -11%). You can see the effect of those units on share in the following graphs.

Continue reading “Surface Tension: The effect of Surface on Windows revenues”

The Critical Path #82: Adding Rows

The Apple Q1 financial performance review with a short look at the impact of warranties on gross margins. The growth question: why financial analysis cannot offer insights into new product creation, and why makers of things think different. Finally, a new installment into Asymcar: why the process of car making is over-integrated, over-serving, and over-concentrated.

5by5 | The Critical Path #82: Adding Rows.

Happy Birthday iTunes Store

iTunes (including software and services) revenues in Q1 topped $4 billion and were 30% higher than (re-stated) 2012 Q1 revenues. Accompanying this revenue figure were additional data points from the company:

- Cumulative app downloads have surpassed 45 billion

- Payments to developers reached a cumulative total of $9 billion

- Payments to developers were $4.5 billion in most recent four quarters

- Now paying $1 billion to developers every quarter

- 800 apps are downloaded every second

- iOS app revenues doubled since year-ago quarter

- App Store accounted for 74% of all app sales in the quarter (citing Canalys)

- App stores reach customers in 155 countries (850k Apps, 350k iPad apps)

- iTunes music downloads are available in 119 countries (35 million songs)

- Movies are sold in 109 countries (60k titles)

- iBookstore is available in 155 countries (1.75 million titles)

This data allows for a few inferences: Continue reading “Happy Birthday iTunes Store”

Margin call update: About those changes in service policies

In the March quarter, our gross margin was 37.5%. It was at the low end of our range. We had a few items that on balance resulted in us reporting at the low end. They included mix, in particular, selling more iPads than we had planned, including getting iPad mini into our four- to six-week channel inventory range, some changes in our service policies that required us to make provisions for prior quarter sales, and we had some unfavorable adjustments.

– Peter Oppenheimer, Apple CFO, FQ2 2013 Earnings Conference Call

[my emphasis]

Thanks to Philip Elmer DeWitt for bringing this quote to my attention in the comments to Margin Call 2.

I was curious about the “changes in service policies” and what that might have meant, especially since they seem to have been retroactive (provisions for prior quarter sales).

The 10Q offers more details:

Accruals for product warranty for the three months ended March 30, 2013 include $414 million associated with product sales in prior fiscal periods reflecting the impact of changes to certain of the Company’s service policies and other estimated warranty costs. Of this amount, $224 million is associated with product sales in the first quarter of 2013, and the remainder is associated with product sales in 2012.

– Apple 10Q, Note 6, Page 17, second paragraph.

Continue reading “Margin call update: About those changes in service policies”

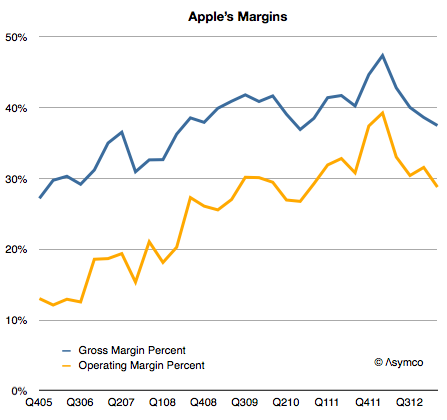

Margin Call 2

I expected Apple’s margins to improve last quarter. They didn’t and so the question I needed to answer is why. Here is a history of Apple’s gross margin and operating margin as reported since late 2005:

For a company selling hardware these are extraordinarily high margins. They are higher than those of Google and have narrowed the gap with Microsoft, neither of which has a high proportion of hardware sales:

Asymco Workshops Australia 2013

I will be in Australia in May and thought to invite local readers to join me for a few hours of in-depth discussion on the future of our industry.

I plan to have an event in Sydney on the 3rd in the morning (9:00 to noon at the Radisson Blu 27 O’Connell. Press Room) and in Melbourne on the 6th in the afternoon (1:30 to 4:30 PM at Victoria University City Flinders Campus: Level 12, Function Room 4, 300 Flinders Street, Melbourne, VIC, 3000).

Nominally, the topic will be: The history and future of computing using disruptive analysis.

I will present recent material (including the latest data from Apple) and we will have a few hours of Q&A.

Tickets are $120 and seating will be limited to 100.

You can register here: Asymco Workshops Australia 2013.

The Critical Path #81: Continuous Flow

We cover misleading headlines with respect to the iPhone at Verizon while questioning the ebb and flow of media tone on Apple news. We also dive deeper into Asymcar and how to think about car manufacturing. Finally, how to approach industry analysis regardless of your industry.