Matteo Fumagalli is a student of economics at University of Insubria, Italy. He is writing a thesis for a bachelor’s degree analyzing the smartphone industry.

He asked me to answer the following questions:

-First question is about you. Why did you found Asymco?

I founded the company to develop software, mainly apps. I began writing the blog as a way to drive traffic to the site. I would have preferred to build a blog only but did not think it was possible to earn any money doing that so I treated it as a hobby. Even after the site became more visible I changed from development to consulting and did not expect that writing in itself could be self-sustaining. It took about two years before I felt comfortable with the idea that I could do writing and speaking exclusively. I am still exploring additional business models however.

-You worked 8 years as analyst and business development manager at Nokia and you anticipated their current crisis with your first post on Asymco. Do you think Nokia will have the chance to recuperate, and eventually what will be the role of Windows Phone?

Nokia may recover or remain independent, at least. But it will be far smaller. The idea of a return to dominance or 40% share seems very unlikely. As I pointed out in the first post, the organization cannot cope with the new marketplace. Large organizations require extreme stress and damage to change. It’s a phenomenon at all levels of society that success results in rigidity. From the individual to the nation to the civilization, success makes change very, very difficult.

Windows Phone is an attempt to create a third ecosystem. I am concerned that the logic of having a third alternative is not solving a consumer need but an operator need. In other words, consumers are not asking for a third option and when they are presented with a third option they are not excited by it. The consumer does not think in terms of increasing their options. They decide once every two years which phone to buy and that is the end of their thinking on the subject. By focusing on the operator’s needs the platform is fundamentally mis-positioned.

What Windows Phone needs to be positioned as is either as fundamentally different, solving a different job for the consumer. Or fundamentally better along a new dimension like price or convenience. These are some of the claims it makes but they are very weak claims right now.

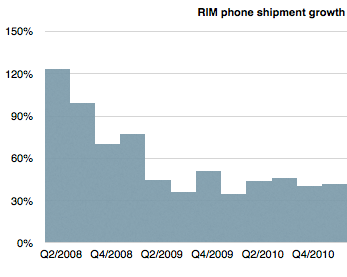

-What about RIM, other company which is going through difficult times? What do you think about their decision not to move to Android and stake everything on their closed OS? Continue reading “An interview with Matteo Fumagalli”