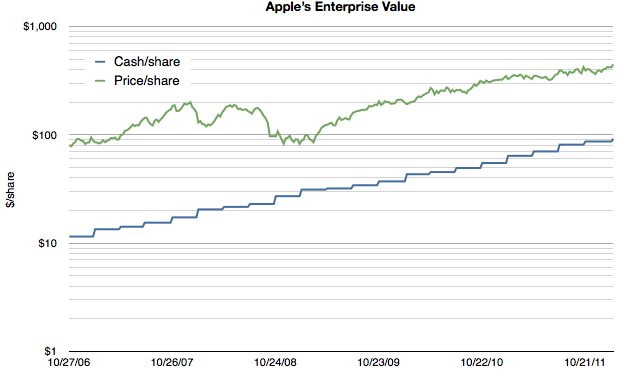

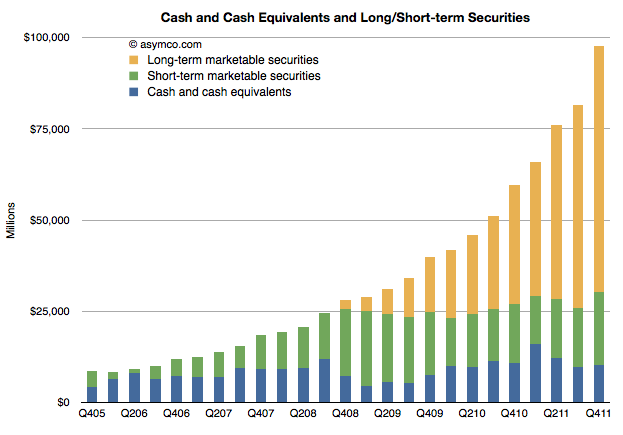

As Apple’s extraordinarily low valuation is being more widely noted, explanatory hypotheses are proliferating. Everyone seems to have an opinion. Some explanations come in and out of fashion. Others are reliable old clichés. We’ve seen liquidity issues with large funds forced to sell, “too much cash”, management transitions, an impending loss of mojo, share price too high to afford, “law of large numbers”, and that old chestnut, competition. None of these satisfy. They don’t explain why reliable growth is not valuable. And reliability is indeed what Apple offers in spades. Consider the following chart:

Note that the scale is logarithmic so that the growth patterns can be seen clearly. Continue reading “Pricing Paradox”