My talk on the future of things from Censhare’s FutureDay 2014 in Munich.

Author: Asymco-admin

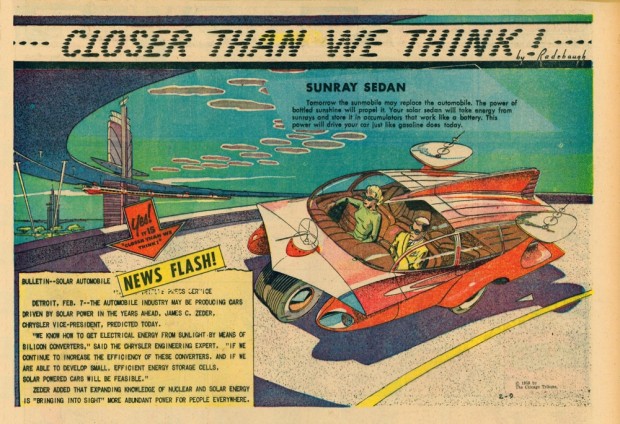

Asymcar 15: Sunray Sedan

Matt Grantham joins us to discuss electric vehicles, renewable energy, smarter software, solar opportunities and economics. Matt introduces us to Solar X, the solar car challenge. He reflects on these emerging technologies in light of Australia’s nearly extinct auto manufacturing sector.

We explore the concept of a car as the home power source and consider possible EV disruption of traditional power generation and distribution concerns. The potential business models arising from these emerging technologies makes us pause in light of solar firm’s stock performance.

Twenty Questions from Catalin Stelian Andrei

Catalin Stelian Andrei, Editor of The Day, INTERNET PROTV asked me twenty questions:

1. What phone do you have in your pocket right now? Why that model?

I carry the iPhone 5. The last iPhone I bought was an iPhone 5C which I gave to a family member.

2. Apple is going to launch, form all we know, an iPhone with a bigger screen, long after their market rivals. Is Apple one step behind, being forced to take this road in the fight with Android and Windows Phone devices? Because many smartphone users were hoping that an big screen iPhone, a redesigned model, will be lauched long time ago, and that didn’t happen.

Making bigger phones is easier than making smaller phones. First because miniaturization has always been the most difficult engineering challenge, and second, because a smaller phone has a smaller battery making efficiency much more important. The larger the phone, the simpler it is. The third reason smaller is more valuable is that it’s easier to carry and use. The largest phones cannot be put in pockets and cannot be used with one hand. In the history of consumer, electronics size reduction has been the most consistent measure of performance, and the most rewarding. Usually the most exceptional reductions in dimensions create the highest price and profit bands. There have been niches for larger portable devices but they are consistently a small part of the overall market. If Apple were to introduce a larger device I hope they will be able to solve usability problems and make the category attractive to a larger audience.

3. What do you expect from the new iPhone 6?

I expect it to run the latest version of iOS and, with the new apps developers will ship, that should make the most impact in people’s lives. I imagine health maintenance and home automation will become valuable new franchises. Of course iOS 8 will also run on older iPhones, but I suspect the newest iPhone will somehow run the new software better and have smoother integration with services.

4. What’s the “not to do” lesson that Apple needs to learn for the now iPhone from it’s own past experience or their competitors?

The biggest challenge is to move rapidly with scale. The company has managed to grow from zero phones a year to hundreds of millions. That’s great but it’s still frustrating to wait one year for major improvements. The “cycle time” of innovation for Apple remains one year. I wish it could be faster but perhaps this is also too fast for some. In some services like maps and iCloud and iWork, which are independent of hardware (mostly,) speed is of the essence.

5. The iPhone is the most expensive smartphone on the market right now. In Romania, it certainly is. But where does Apple gains it’s most money from, selling products to users or selling services, like iTunes, App Store? And having that in mind, what will be their next step: better – breakthrough products or bigger, more complete services?

The answer to where a company “gets its profits” is best answered by asking where a buyer “gets his value” from the product. For instance you might answer the question of where a car company gets its value by saying that it’s from making people be in more than one place in a day. So the “differentiation” of a car is in answering the question slightly differently. If it’s hard to see a difference to this answer between cars then it’s hard for any one company to make a profit. For a company like Apple, we need to ask what its users value about the experience and why they are willing to pay for that. My hypothesis is that the brand’s value is in making life a little bit easier. That’s what Apple competes on. Of course, some people are not willing to pay to have an easier life and some even want to make their lives more complicated so Apple’s proposal to make life easier, for a price, is not accepted by everybody—which is ok by them. But for many, paying for comfort, productivity and ease of mind is worth quite a bit. The reason Apple is able to gain a premium over the competition is that this value proposal (of paying for simplification) is either weak or non-existent for competitors. Indeed, many competitors compete on the basis of making life more complicated.

6. What does innovation means for Apple right now? What are their options for assuring a next decade of success? A new Steve Jobs person or a Steve Jobs tipe of group thinking. How hard is that to achieve?

Innovation is meaningful invention—bringing useful creations to a large number of people who then make use of that creation. The interesting aspect of making money from innovation is that it’s a rare phenomenon, requiring many disciplines to work together. It’s like a big movie that somehow works and becomes widely popular but costs little to make. Many movies are made, few are successful and very few of those which are successful are built at low cost. What we know about technology innovation is that it’s a combination that comes together under strong leadership but that leadership alone is not sufficient. The myth of Steve Jobs is that he was both necessary and sufficient to success. The truth is that he was necessary but not sufficient. To make successful innovations requires strong leadership and teamwork and a process of incentives and passion that is hard to create a formula for. How this works at Apple is its biggest secret.

7. Who are the key Apple employees right now? Do they need another Jobs or do they already have him?

All Apple employees are key. I would say that’s the magic formula. There is no chief magical officer (and there never was.)

8. What will be the next best thing for Apple? […]

I don’t know. It’s probably not knowable. Continue reading “Twenty Questions from Catalin Stelian Andrei”

Asymcar 14: Grand Prix. An interview with Ossi Oikarinen

An interview with Ossi Oikarinen, Technical Director at Team Rosberg, a 30-year veteran of motorsport, Formula One TV presenter and deep insider.

We cover Grand Prix racing and DTM touring cars from the point of view of business models, jobs to be done and technical innovations. We touch on many other fine points.

This is a good one.

via Asymcar 14: Grand Prix. An interview with Ossi Oikarinen | Asymcar.

The greatest show on earth

Dan Niles, a former analyst who is now a portfolio manager, said on a CNBC appearance that the WWDC event actually had nothing of any real meat for investors

From Worldwide Developer’s Conference Prompts Analysts to Raise Apple Price Targets – 24/7 Wall St.

The “investors” that Dan Niles refers to are undoubtedly those who invest (or, more accurately, speculate with) money. But the audience for the event was an entirely different set of investors. These investors1 invest their passion, intellect and a substantial fraction of their lives with Apple.

For them WWDC had a great deal of meat. Indeed, for them, it was probably the most significant event Apple ever staged.

The path to realizing this is to imagine the world as the “D” in WWDC see it. Developers don’t just build. Using an analogy of building or construction, they are architects and designers as well as contractors and craftsmen and artists as well as builders. And not of just of houses but of cities and communities. They see and think through tools and techniques for building and innovations in building materials. Innovations which allow them to imagine first and, later, to build new cities in ways that were never before possible.

We were therefore witnesses to an event which was, in essence, a cement conference. A new building material was introduced along with the methods for using it and the tools for shaping it. Perhaps some observers expected to see skyscrapers and interstate highways presented, and thus were disappointed. But they should not have had such expectations. A cement conference is esoteric. It’s about the rudiments which, when combined with imagination, ingenuity and a lot of work, generate livable spaces.

A few spaces go beyond comfort and delight us. Fewer still enlighten and cause the sprit to soar.

And yet it was still a cement conference.

Perhaps the way to understand the show better would be to “play it backwards.” Rather than the way it was presented, let us begin with the end:

We were shown a new concrete formulation which when coupled with a new way of mixing, forming and curing can lead to increases in productivity of construction. This is especially true when producing shapes that are complex, intricate and built into modules.

We were then introduced to some pre-formed kits that allow the materials to be combined for new uses such as flexibly shaped hospitals and gyms. And we would have to stretch only slightly to imagine how this might lead to better health and wellbeing.

Then we were shown examples of new ways that this cement was used to create new work environments. We had a preview of “show homes” beautifully architected and designed. And these homes were seamlessly connected through new transportation networks and allowed for easier commutes. Again, it did not take much to imagine how these workspaces and homes would lead to greater productivity and how other spaces could be built around them that made such a collection of communities a wonderful place to be.

Some saw banks, and some saw art galleries and some saw warehouses, but all who were there were seeing a new world, populated by many loyal citizens.

Perhaps not populated by all. Indeed, such a country is not for everybody, perhaps only a billion people could be resident and it would not be cheap to live there. But still, imagine.

So this was the way I saw WWDC 2014. A cement conference cheered by cement enthusiasts but leaving Architectural Digest writers asking what the fuss was all about.

- All nine million of them [↩]

Pragmatic Episode 22: Core Business

Understanding what is and isn’t your core business is critical for success. Horace Dediu joins John Chidgey for a very special episode of Pragmatic where for once John doesn’t do all the talking!

via Tech Distortion.

Postmodern Computing (Summit)

Steve Jobs famously said that Apple stands at the intersection of of Technology and the Liberal Arts. He said it more than once because he thought it was an important distinction of the company.

In an intuitive way, the message may have gotten through to the average person, but I don’t think professional observers and managers of technology have quite grasped what he meant.

It’s not a glib throw-away marketing phrase. I can imagine many other, more evocative ways of saying that Apple blends the hard and the soft; the heart and mind, if you will.

His choice of words makes me believe that he meant it as a fundamental blending of two disparate and considered-opposite concepts, rather like yin-yang: things which do not naturally mix but which are complementary, interconnected, interdependent, and give rise to each other.

This interaction however is not well understood and even more rarely exploited. The reason they don’t mix well in business in particular is that individuals are typically not trained in both. Our education systems (from where these phrases originate) are unwilling or incapable of providing us with a grounding in both, so individuals tend to absorb only one or the other.

But it turns out that the interaction between these nominal opposites have determined our world to date and will continue to determine our fate. A cursory review of history shows that the “soft”, perceptive and feeling-based disciplines always combined with the analytical and judgmental to create a future which neither could create alone.

I note how Apple uses this combination to an advantage and have also used this methodology myself to understand and sense the future. Taking this method further, I would like to share it with others. I would like to recognize some faint but powerful patterns and bare some of the more audacious conclusions of my analysis.

The method chosen is a forum we are convening called The Post Modern Computing Summit.

It’s a small gathering where we are inviting the most enlightened thinkers of the future of computing to lead us into its next age, and perhaps, tentatively, the next era of civilization.1

- We’ll also answer the questions of where tablets are going, and where they will takes us, what is the future of apparel computing, what does intimate computing mean and who will benefit and who won’t. [↩]

The iPad discontinuity

iPad sales were unexpectedly slow in Q1. Tim Cook explained it as follows:

iPad sales came in at the high end of our expectations, but we realized they were below analysts’ estimates and I would like to proactively address why we think there was a difference. We believe almost all of the difference can be explained by two factors.

First, in the March quarter last year we significantly increased iPad channel inventory, while this year we significantly reduced it.

Second, we ended the December quarter last year with a substantial backlog of iPad mini that was subsequently shipped in the March quarter whereas we ended the December quarter this year near supply demand balance.

We continue to believe that the tablet market will surpass the PC market in size within the next few years, and we believe that Apple will be a major beneficiary of this trend.

Tim Cook went on to say “over two-thirds of people registering an iPad in the last six months were new to iPad”

In a later discussion, Luca Maestri said:

As Tim explained earlier, our iPad results and the comparison to the March quarter last year were heavily influenced by channel inventory changes. Specifically, this year we sold 16.4 million iPad into our channel and sold through almost 17.5 million, reducing our channel inventory by 1.1 million units.

Last year, we sold over 19.4 million iPads into our channels and sold through 18 million, and therefore increased channel inventory by 1.4 million units. As a result, the year-over-year sell through decline was only 3% compared to the sell-in decline of 16%.

We exit the March quarter with 5.1 million of iPad channel inventory which left us within our target range of four to six weeks. iPad continues to lead all other tablet by far in terms of user engagement, size of ecosystem, customer satisfaction and e-commerce.

In a later Q&A: Continue reading “The iPad discontinuity”

On the future of Google. Part 2

In Part 1 of a look at Google’s future I showed that Google’s revenues have been highly correlated with the population of Internet users in the markets it serves. If there were a causal relationship between population of users and revenue growth then the company would face a growth inflection point when that population becomes half penetrated.

In Significant Digits Episode 1 (Part 1) I showed data which suggests that the inflection point will come in 2016. Essentially the argument is that Google’s growth is ultimately limited by the population of users and that itself is a predictable number. I also used the example of the PC and smartphone penetration curves to show how the perception of the fortunes of companies whose revenues are based on those technologies were affected by inflections in their respective adoptions.

However, correlation is not causation. These users we count are not the customers who pay for Google’s services. Users (or usage) is therefore only a proxy. It may be a good proxy and intuitively it makes sense that it’s a driver of growth but fundamentally the company lives on a stream of revenues paid by advertisers1. In order to really evaluate the opportunity we need to “follow the money” and track down where it comes from.

We don’t have visibility into the exact sources of these revenues but we have a top-level geographic segmentation (shown below.) Continue reading “On the future of Google. Part 2”

- This is true to date and certainly it could change but hints of how that might change are still not visible to me [↩]

Ruby on Rails Podcast #146: Horace Dediu of Asymco – Open Source Software

Sean Devine has a conversation with Horace Dediu of Asymco about open source software.

via 5by5 | Ruby on Rails Podcast #146: Horace Dediu of Asymco – Open Source Software.