If software can be injected into an industry’s product it will bend to the will of the software writers.

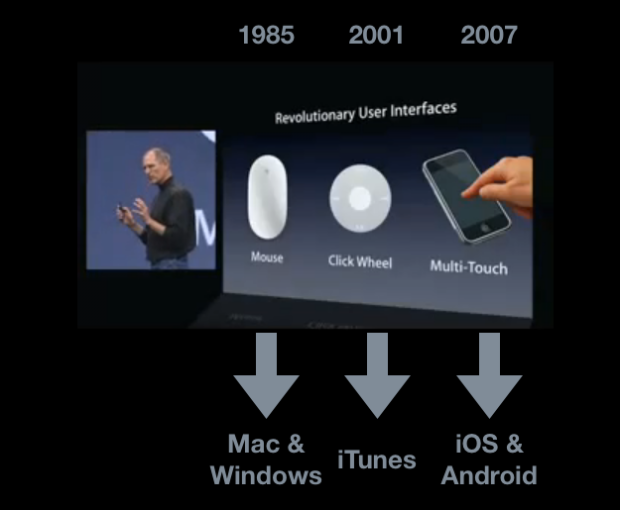

This theory expands on Marc Andreessen’s observation that “software is eating the world”. The evidence is that software, coupled with microprocessors, sensors, batteries and networking becomes applicable to an increasingly larger set of problems to be solved. Software has “eaten” large portions of entertainment (e.g. Pixar, iTunes, video games), telecommunications (iPhone, Android, Messaging), various professions including journalism, management and law, and is entering transportation, energy and health care and poised over banking, finance and government.

As entry happens, asymmetries are enabled and disruption follows. This is the bending to the will of the writers–who tend not to be incumbents. The incumbents can’t embrace the changes in business models enabled by software without destroying their core businesses and thus, invariably, they disappear.

The pattern is easily observed but the speed and timing of it is difficult to predict and hence investment success is not certain. There are many entrants who try and few succeed and there are many incumbents who will survive longer than a prophet can stay hungry.

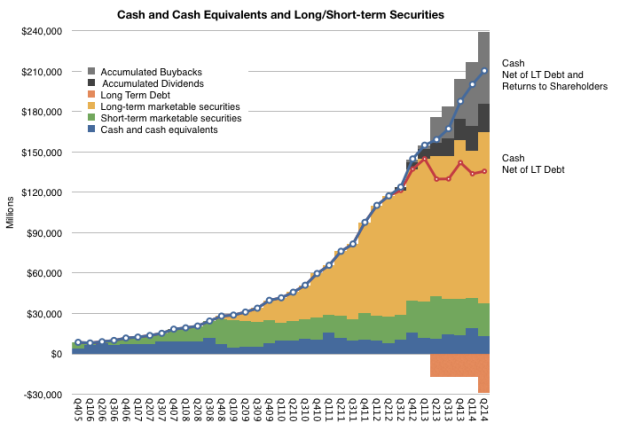

Nevertheless, this process of software-induced turnover in wealth–and, incidentally, vast, additional wealth creation–is inevitable.

But can we predict anything other than timing? For example, can we predict the next industry to succumb to this force?

Continue reading “Apparel is next”