9:00 to 10:15 Being Back. How California came to disrupt

The disruptive history of California is remarkable. Whereas few nations can claim credit to one, California is home to at least four major disruptions: Semiconductors, recorded entertainment, venture capital and personal computing. And it did all this in less than one century. If any one place can vie for the title of “serial disruptor” it’s California. One success can be seen as luck, but many successes imply a system is at work. In this case session we discuss California’s disruptive history and put forward hypotheses on the what causal mechanisms are at work. We ask further whether California can still be the home of future disruptions or whether the system has broken down.

- The effect of “frontier mentality” on unforeseen growth

- The effect of migration and diaspora on innovation and counter-effect of the absence of either.

- Applying these causal themes to the management of innovation in institutions

10:15 to 10:30 Break

10:30 to 12:00 Designed in California, Assembled in China

Geographically and culturally, California is closer to Asia than any other western market. It has always faced west more than it has faced east. Is there a symbiosis between California and Asia? Are its institutions adapting to a new center of economic mass? Is California leading in thinking or culture or is it being disrupted by a new frontier as growth moves east?

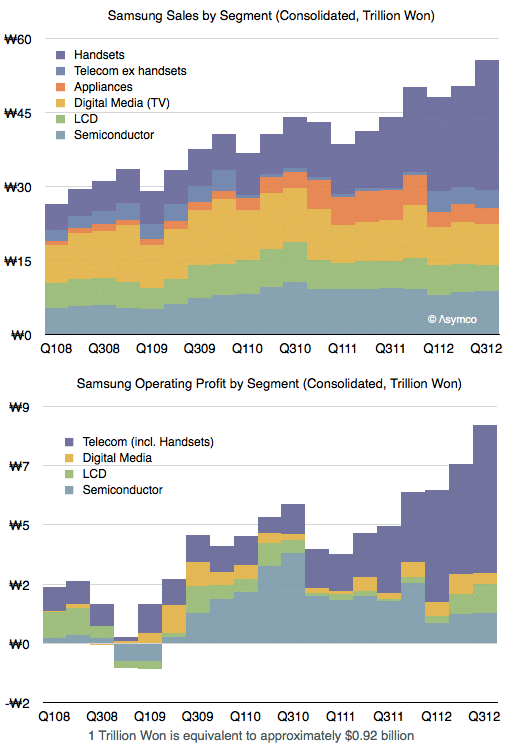

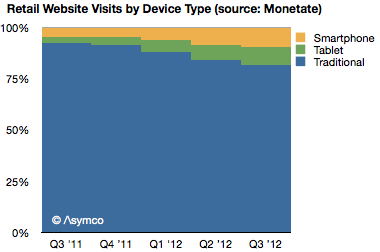

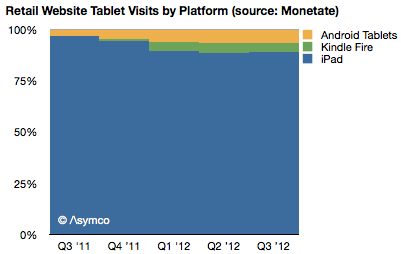

- The growth in Asia and China in particular is in many ways a reflection of rapid industrialization. But it can also be seen as a low-end disruption.

- What can be learned about business model innovation in the contrast between Californian and Asian approaches to business?

- Does culture play a part in an innovation mentality?

12:00 to 1:00 Lunch

1:00 to 2:15 Guest presentations and Panel session

Guests are invited to debate or discuss points raised during the morning sessions. A chance for panelists to challenge or refute points made as well as for the provision of anecdotal evidence.

Potential panelists:

- Ben Bajarin

- Michael Lopp (aka @Rands)

- Jean-Louis Gassée

- Om Malik

- Charlie Kindel

- Dan Benjamin

- Philip Elmer-DeWitt

- Tim Bradshaw

2:15 to 2:30 Break

2:30 to 4:00 North vs. South

Does the tension between industries of Northern California and Southern California reflect an opportunity or a crisis? We will re-visit the narrative of what Entertainment is hired to do. We will review the differences and similarities of the technological creative process vs. the artistic creative process. We will see whether industrialized, commercialized art is subject to disruptive forces or whether there is persistent exceptionalism at work.

- Is the intersection of “liberal arts” and “engineering” more than a metaphor?

- What can be learned by cross-pollination of the creative processes of engineers and artists.

- What’s the future of technology-based entertainment? Are North and South closer and have more in common than the war talk lets on?

4:00 to 6:00 Reception

Please register here.