In this special “live” version of The Critical Path, Horace gets the numbers just minutes before Apples January 27th, 2015 earnings call and dissects them live. The show picks up just after the call finishes with a quick recap and discussion of yet another record quarter.

Year: 2015

The S&P 499

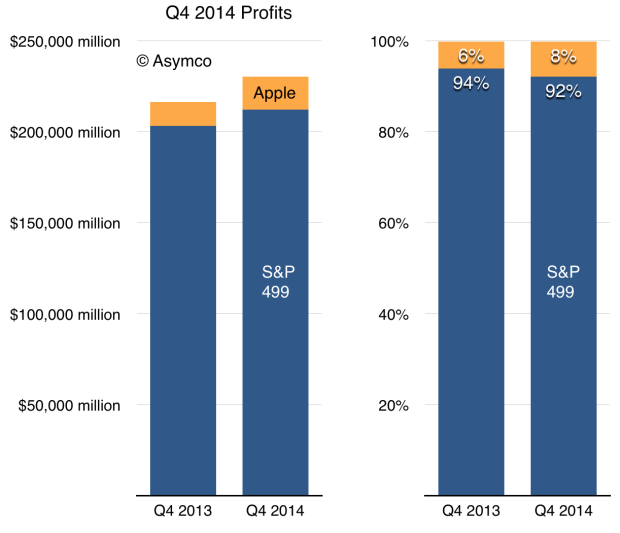

Thomson Reuters reported that excluding Apple, the entire S&P 500 grew profits at a rate of 4.4%. Including Apple the figure is 6.4%.

Using one weird trick1 I calculated the value of profits generated by the S&P 499 (i.e.the largest public companies excluding Apple) in Q4 2013 and Q4 2014.

Apple therefore accounted for nearly 8% of the S&P 500 in the last quarter. A year earlier Apple was a mere 6%.

It should therefore be obvious why Apple’s P/E ratio is 16.1 while the S&P 499 P/E ratio is 19.8.

- Algebra [↩]

How many iOS devices did/will Apple ship?

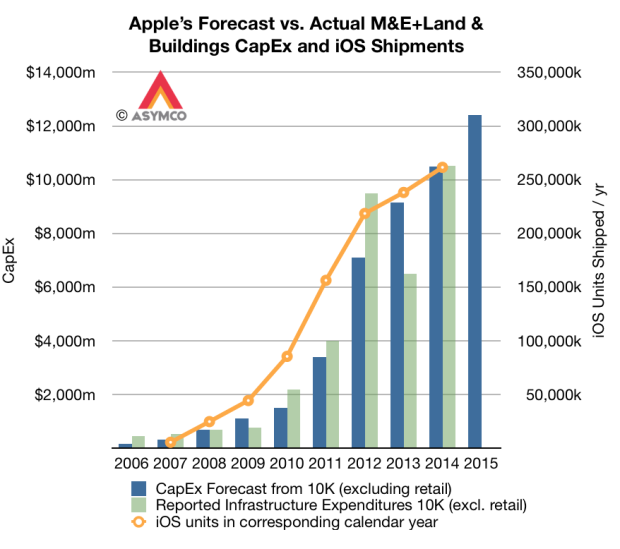

Last August I wrote:

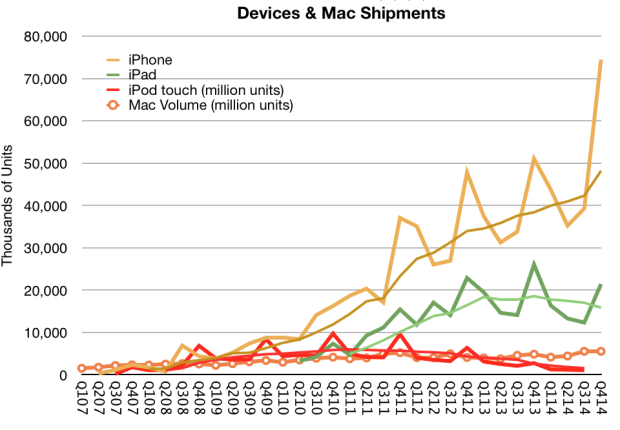

It’s therefore reasonable to assume that calendar 2014 will see at least 250 million iOS devices sold

The actual figure was 259.5 million.

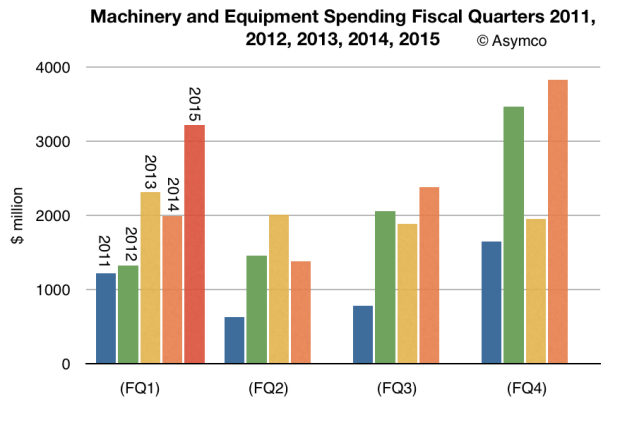

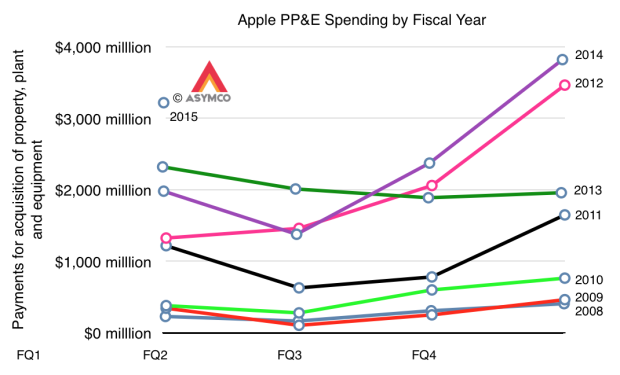

Looking ahead, the capital spending pattern so far shows a distinct rise heading into Q1.

This could be partly due to the new campus, the new Watch production ramp and perhaps new iPad models.

Nevertheless, I think it’s safe to predict that the company is on track to ship 310 to 320 million iOS devices in 2015.

Nevertheless, I think it’s safe to predict that the company is on track to ship 310 to 320 million iOS devices in 2015.

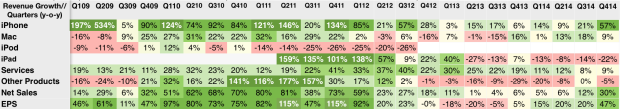

Apple’s Growth Scorecard

Apple’s Net Sales grew at the rate of 30% in the last quarter. Earnings per share grew at 47%. Both of these figures are the highest since 2012.

It should be noted that although the rate of growth is extraordinarily high, the company never actually stopped growing in the past three years. As the table above shows, net sales has always had positive growth.

Compared with the fourth calendar quarter of 2011, Apple’s sales are 61% higher and earnings per share are 54% share.1

This degree of growth at this stage in the history of the markets it participates in is a revelation.

Consider:

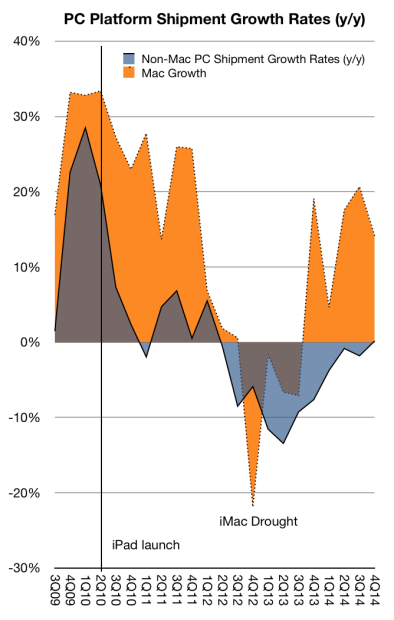

- The PC market is more than 30 years old. In this mature market the Mac has been outgrowing the Windows platform for 34 out of the last 35 quarters.

- The iPhone was announced eight years ago and it still managed to grow at the rate of 57%.

- The market shares of its Mac, iPhone and iPad products are all remarkable only for their paucity.

- The pricing of all their products is more than double the median for their categories.

- Regardless of extreme growth, pricing power, headroom and, most importantly, customer loyalty, the company’s prospects are seen as dismal in contrast to its underperforming peers.2

- Such is the plight of the anomalous.

Asymcar 21: Where we’re going, we don’t need roads

Gartner asserts that “connected cars or smart cars are poised to play a pivotal role in the Internet of Things (IoT)”. We say “Hah!”

Also,

- Who levies automotive platform taxes?

- What in the world could “over serving” transportation mean?

- Using the Automatic app in a Porsche.

- BMW’s “sounding the alarm” over tech companies efforts to collect auto data.

- China’s car industry and other unimportant details relative to declining interest in driving among young people.

via Asymcar 21: Where we’re going, we don’t need roads | Asymcar.

Haunted Empire

The “Stupid manager theory of company failure” (and its corollary, the “Smart manager theory of company success”1) remains the most popular, perhaps even the most universally accepted theory of management. Book after book, thoughtful article after article alludes to this theory and whenever a company is perceived to be under-performing, all fingers point to the leadership with demands for blood letting.

This is not a new phenomenon. When catastrophe strikes, as a thoughtful species, we have always asked for leaders to be sacrificed. In Europe during the Iron age leaders were sacrificed when crops failed. In South and Central America leaders were ceremonially tortured for similar reasons.

Of course most crop failures were due to weather phenomena and the anointed leadership had nothing to do with these causes. Nevertheless ancient correlation analysis would have revealed the pattern that good leadership meant good weather and bad leadership meant bad weather.

There was a balance to the downside however. When times were good the leadership enjoyed luxuries and praise. This was the essential deal societies made: we’ll keep you in riches and allow you to be idle as long as times are good but ritualistically slaughter you when times are bad. We’ll declare you “chief magical officer” and place all our faith in you. But, of course, if you fail, we will will be vengeful.

And so it goes in today’s corporate world. I’ve often said that corporate governance is medieval, or pre-scientific in its approach to understanding causality. That may be too generous. As far as the reward/punishment system (also known as Human Resources) it’s probably pre-neolithic. The luxuries and extravagance which we heap upon the leader provide abundant evidence. Leaders insist on these ironic “pay packages” and boards approve them because they know they can and will be ritualistically sacrificed if and when the mobs turn against them.

A manager would be a fool to accept even generous pay given the risk, actually near certainty, of ritualistic slaughter. They demand and are unquestionably given absurd pay that has no relationship to performance. Such pay has no relationship to performance because it isn’t designed to reward performance but to account for the risk of arbitrary and very public sacrifice. Boards (and hence shareholders) are deliberately hiring a scapegoat for sins as yet unknown. Luxury and violence are thus finely balanced in what is called “Executive Search”.

Continue reading “Haunted Empire”

- As well as the “Smart/Stupid leader theory of national success/failure” [↩]

The Critical Path #139: The Great Gap

Horace and Anders discuss the current uncertainty in the commodities markets and take a look at the logical segments of the adoption curve. Could the conventional wisdom between invention and product in the market be wrong?

Bigger than Hollywood

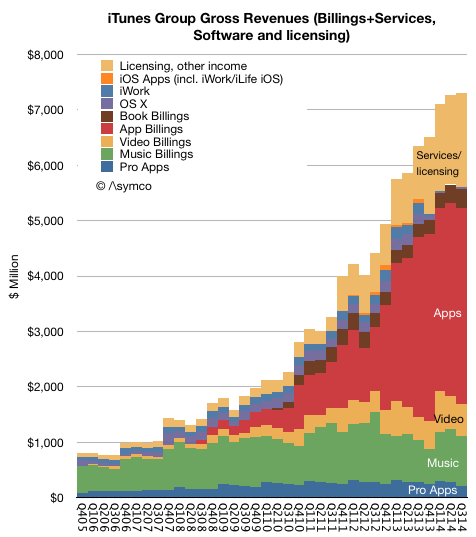

Apple paid $10 billion to developers in calendar 2014. Additional statistics for the App store are:

- $500 million spent on iOS apps in first week of January 2015

- Billings for apps increased 50% in 2014

- Cumulative developer revenues were $25 billion (making 2014 revenues 40% of all app sales since store opened in 2008)

- 627,000 jobs created in the US

- 1.4 million iOS apps catalog is sold in 155 countries

Putting these data points together with others from previous releases results in a fairly clear picture of the iTunes/Software/Services1

The App ecosystem billings (what consumers actually pay) is shown in the red area above. 70% of those payments are transferred directly to developers and Apple reports the 30% remaining as part of its revenues. This view of the iTunes ecosystem shows the impact of Apps relative to the other media types. When we measure the payments to the content owners we can see that Apps also dominate: Continue reading “Bigger than Hollywood”

- soon to be renamed Services and encompass everything under the heading of iTunes software and services today including content, apps, licensing and other services and beginning Q4 2014 it will also include Apple Pay. [↩]

The Critical Path #138: The Critical MBA

Horace and Anders discuss this years CES, Apples record $25B in payments to developers as well as the initial installment of the Critical Path MBA. How is business taught in schools? What is a business school graduate optimized to do? Horace explains what one might need to know when considering a business degree.

The Critical Path #137: The Inception

Can we measure the time between inception of an idea and the disruption it later causes in the market? Startups are there to discover a job nobody sees yet but not all laboratory experiments make it to commercialization. Horace and Anders discuss the timing of disruption and look at Bitcoin as an example.